Exponential Functions

India is the second most populous country in the world, with a population in 2008 of about 1.14 billion people. The population is growing by about 1.34% each year. We might ask if we can find a formula to model the population, P, as a function of time, t, in years after 2008, if the population continues to grow at this rate.

In linear growth, we had a constant rate of change – a constant number that the output increased for each increase in input. For example, in the equation ![]() , the slope tells us the output increases by three each time the input increases by one. This population scenario is different – we have a percent rate of change rather than a constant number of people as our rate of change. To see the significance of this difference consider these two companies:

, the slope tells us the output increases by three each time the input increases by one. This population scenario is different – we have a percent rate of change rather than a constant number of people as our rate of change. To see the significance of this difference consider these two companies:

Company A has 100 stores, and expands by opening 50 new stores a year.

Company B has 100 stores, and expands by increasing the number of stores by 50% of their total each year.

Looking at a few years of growth for these companies:

| Year | Stores, Company A | Stores, Company B |

| 0 | 100 | Starting with 100 each | 100 |

| 1 | 100 + 50 = 150 | They both grow by 50 stores in the first year. | 100 + 50% of 100

100 + 0.50(100) = 150 |

| 2 | 150 + 50 = 200 | Store A grows by 50, Store B grows by 75 | 150 + 50% of 150

150 + 0.50(150) = 225 |

| 3 | 200 + 50 = 250 | Store A grows by 50, Store B grows by 112.5 | 225 + 50% of 225

225 + 0.50(225) = 337.5 |

Notice that with the percent growth rate, each year the company grows by 50% of the current year’s total, so as the company grows larger, the number of stores added in a year grows as well.

To try to simplify the calculations, notice that after 1 year the number of stores for company B was:

100 + 0.50(100) or equivalently by factoring

100(1 + 0.50) = 150

We can think of this as “the new number of stores is the original 100% plus another 50%”.

After 2 years, the number of stores was:

150 + 0.50(150) or equivalently by factoring

150(1 + 0.50) now recall the 150 came from 100(1 + 0.50). Substituting that,

100(1 + 0.50)(1 + 0.50) = 100(1 + 0.50)2 = 225.

After 3 years, the number of stores was:

225 + 0.50(225) or equivalently by factoring

225(1 + 0.50) now recall the 225 came from 100(1 + 0.50)2 . Substituting that,

100(1 + 0.50)2(1 + 0.50) = 100(1 + 0.50)3 = 337.5.

From this, we can generalize, noticing that to show a 50% increase, each year we multiply by a factor of (1 + 0.50), so after n years, our equation would be

B(n) = 100(1 + 0.50)n

In this equation, the 100 represented the initial quantity, and the 0.50 was the percent growth rate. Generalizing further, we arrive at the general form of exponential functions.

Exponential function: An exponential growth or decay function is a function that grows or shrinks at a constant percent growth rate. The equation can be written in the form:

![]() or

or ![]() where

where ![]()

Where:

a is the initial or starting value of the function,

r is the percent growth or decay rate, written as a decimal,

b is the growth factor or growth multiplier. Since powers of negative numbers behave strangely, we limit b to positive values.

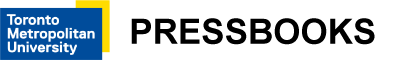

To see more clearly the difference between exponential and linear growth, compare the two tables and graphs below, which illustrate the growth of company A and B described above over a longer time frame if the growth patterns were to continue.

| Year | Company A | Company B |

| 2 | 200 | 225 |

|

|

| 4 | 300 | 506 | ||

| 6 | 400 | 1139 | ||

| 8 | 500 | 2563 | ||

| 10 | 600 | 5767 |

Example 4.1.1

Write an exponential function for India’s population, and use it to predict the population in 2020.

At the beginning of the chapter we were given India’s population of 1.14 billion in the year 2008 and a percent growth rate of 1.34%. Using 2008 as our starting time (t = 0), our initial population will be 1.14 billion. Since the percent growth rate was 1.34%, our value for r is 0.0134.

Using the basic formula for exponential growth ![]() we can write the formula,

we can write the formula, ![]()

To estimate the population in 2020, we evaluate the function at t = 12, since 2020 is 12 years after 2008.

![]() billion people in 2020.

billion people in 2020.

Example 4.1.2

A guaranteed investment certificate (GIC) is a type of savings account offered by banks, typically offering a higher interest rate in return for a fixed length of time you will leave your money invested. If a bank offers a 24 month GIC with an annual interest rate of 1.2% compounded monthly, how much will a $1000 investment grow to over those 24 months?

First, we must notice that the interest rate is an annual rate, but is compounded monthly, meaning interest is calculated and added to the account monthly.

To find the monthly interest rate, we divide the annual rate of 1.2% by 12 since there are 12 months in a year: 1.2% / 12 = 0.1%. Each month we will earn 0.1% interest.

From this, we can set up an exponential function, with our initial amount of $1000 and a growth rate of r = 0.001, and our input m measured in months.

![]()

![]()

After 24 months, the account will have grown to: ![]()

In all of the preceding examples, we saw exponential growth. Exponential functions can also be used to model quantities that are decreasing at a constant percent rate. An example of this is radioactive decay, a process in which radioactive isotopes of certain atoms transform to an atom of a different type, causing a percentage decrease of the original material over time.

Example 4.1.3

Bismuth-210 is an isotope that radioactively decays by about 13% each day, meaning 13% of the remaining Bismuth-210 transforms into another atom (polonium-210 in this case) each day. If you begin with 100 mg of Bismuth-210, how much remains after one week?

With radioactive decay, instead of the quantity increasing at a percent rate, the quantity is decreasing at a percent rate. Our initial quantity is a = 100 mg, and our growth rate will be negative 13%, since we are decreasing: r = -0.13. This gives the equation:

![]()

This can also be explained by recognizing that if 13% decays, then 87% remains.

After one week, 7 days, the quantity remaining would be ![]() mg of Bismuth-210 remains.

mg of Bismuth-210 remains.

Example 4.1.4

T(q) represents the total number of Android smartphone contracts, in thousands, held by a certain Rogers store region measured quarterly since January 1, 2010. Interpret all of the parts of the equation: ![]() .

.

Interpreting this from the basic exponential form, we know that 86 is our initial value. This means that on Jan. 1, 2010 this region had 86,000 Android smartphone contracts. Since b = 1 + r = 1.64, we know that every quarter the number of smartphone contracts grows by 64%. T(2) = 231.3056 means that in the 2nd quarter (or at the end of the second quarter) there were approximately 231,305 Android smart phone contracts.

Finding Equations of Exponential Functions

In the previous examples, we were able to write equations for exponential functions since we knew the initial quantity and the growth rate. If we do not know the growth rate, but instead know only some input and output pairs of values, we can still construct an exponential function.

Example 4.1.5

In 2002, a company had 80 retail stores. By 2008, the company had grown to 180 retail stores. If the company is growing exponentially, find a formula for the function.

By defining our input variable to be t, years after 2002, the information listed can be written as two input-output pairs: (0, 80) and (6, 180). Notice that by choosing our input variable to be measured as years after the first year value provided, we have effectively “given” ourselves the initial value for the function: a = 80. This gives us an equation of the form f(t) = 80bt .

Substituting in our second input-output pair allows us to solve for b:

![]() Divide by 80

Divide by 80

![]() Take the 6th root of both sides.

Take the 6th root of both sides.

![]()

This gives us our equation for the population:

![]()

Recall that since b = 1+r, we can interpret this to mean that the population growth rate is r = 0.1447, and so the population is growing by about 14.47% each year.

In this example, you could also have used ![]() to evaluate the 6th root if your calculator doesn’t have an nth root button. We chose to use the f(x) = abx form of the exponential function rather than the f(x) = a(1 + r)x form, but this choice was entirely arbitrary – either form would be fine to use.

to evaluate the 6th root if your calculator doesn’t have an nth root button. We chose to use the f(x) = abx form of the exponential function rather than the f(x) = a(1 + r)x form, but this choice was entirely arbitrary – either form would be fine to use.

When finding equations, the value for b or r will usually have to be rounded to be written easily. To preserve accuracy, it is important to not over-round these values. Typically, you want to be sure to preserve at least 3 significant digits in the growth rate. For example, if your value for r was 0.00317643, you would want to round this no further than to 0.00318.

Graphs of Exponentials

To get a sense for the behaviour of exponentials, let us begin by looking more closely at the function f(x) = 2x . Listing a table of values for this function:

| x | -3 | -2 | -1 | 0 | 1 | 2 | 3 |

| f(x) | 1 | 2 | 4 | 8 |

Notice that:

- This function is positive for all values of x.

- As x increases, the function grows faster and faster (the rate of change increases).

- As x decreases, the function values grow smaller, approaching zero.

- This is an example of exponential growth.

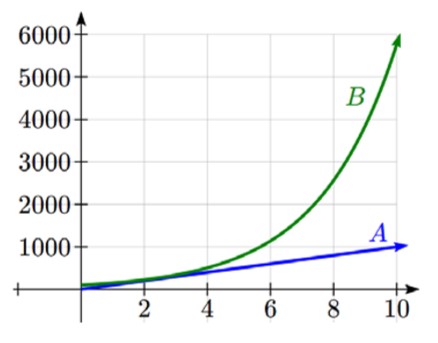

Looking at the function ![]()

| x | -3 | -2 | -1 | 0 | 1 | 2 | 3 |

| g(x) | 8 | 4 | 2 | 1 |

Note this function is also positive for all values of x, but in this case grows as x decreases, and decreases towards zero as x increases. This is an example of exponential decay. You may notice from the table that this function appears to be the horizontal reflection of the f(x) = 2x table. This is in fact the case:

![]()

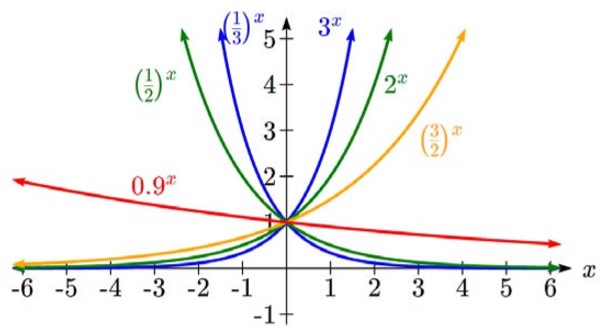

Looking at the graphs also confirms this relationship:

Consider a function for the form f(x) = abx . Since a, which we called the initial value in the last section, is the function value at an input of zero, a will give us the vertical intercept of the graph. From the graphs above, we can see that an exponential graph will have a horizontal asymptote on one side of the graph, and can either increase or decrease, depending upon the growth factor. A horizontal asymptote is a horizontal line y = b where the graph approaches the line as the inputs get large. The horizontal asymptote will help us determine the long run behaviour and is easy to determine from the graph.

The graph will grow when the growth rate is positive, which will make the growth factor b larger than one. When it’s negative, the growth factor will be less than one.

Graphical Features of Exponential Functions:

- Graphically, in the function f(x) = abx

- a is the vertical intercept of the graph

- b determines the rate at which the graph grows. When a is positive,

- the function will increase if b > 1

- the function will decrease if 0 < b < 1

- The graph will have a horizontal asymptote at y = 0.

- The graph will be concave up if a > 0; concave down if a < 0.

- The domain of the function is all real numbers.

- The range of the function is (0, ∞).

When sketching the graph of an exponential function, it can be helpful to remember that the graph will pass through the points (0, a) and (1, ab).

The value b will determine the function’s long run behavior:

If b > 1, as x→∞ , f(x)→∞ and as x→-∞ , f(x)→0.

If 0 < b < 1, as x→∞ , f(x)→0 and as x→-∞ , f(x)→∞ .

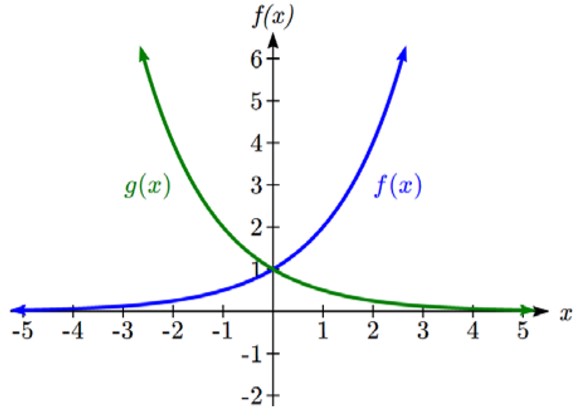

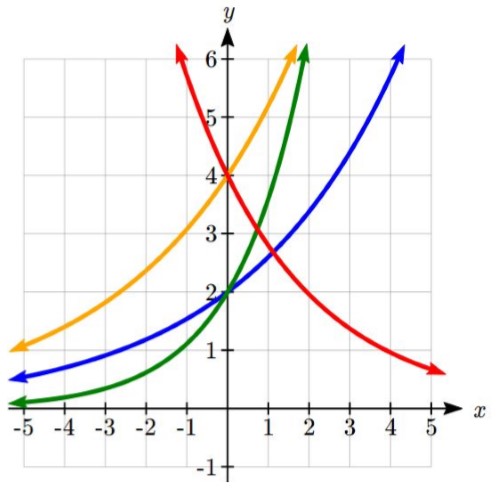

Example 4.1.6

Sketch a graph of ![]()

This graph will have a vertical intercept at (0,4), and pass through the point (1, ![]() ) . Since b < 1, the graph will be decreasing towards zero. Since a > 0, the graph will be concave up.

) . Since b < 1, the graph will be decreasing towards zero. Since a > 0, the graph will be concave up.

We can also see from the graph the long run behavior: as x→∞ , f(x)→0 and as x→-∞ , f(x)→∞ .

To get a better feeling for the effect of a and b on the graph, examine the sets of graphs below. The first set shows various graphs, where a remains the same and we only change the value for b.

Notice that the closer the value of b is to 1, the less steep the graph will be.

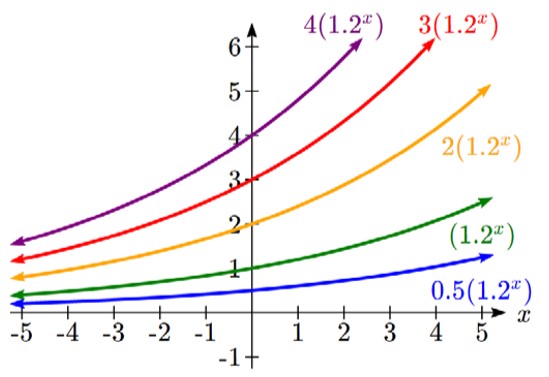

In the next set of graphs, a is altered and our value for b remains the same.

Notice that changing the value for a changes the vertical intercept. Since a is multiplying the bx term, a acts as a vertical stretch factor, not as a shift. Notice also that the long run behavior for all of these functions is the same because the growth factor did not change and none of these a values introduced a vertical flip.

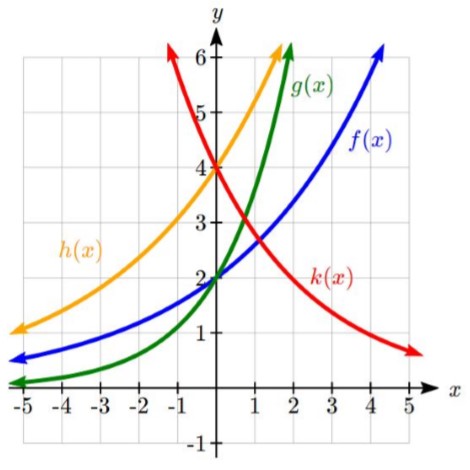

Example 4.1.7

Match each equation with its graph.

|

|

The graph of k(x) is the easiest to identify, since it is the only equation with a growth factor less than one, which will produce a decreasing graph. The graph of h(x) can be identified as the only growing exponential function with a vertical intercept at (0, 4). The graphs of f(x) and g(x) both have a vertical intercept at (0, 2), but since g(x) has a larger growth factor, we can identify it as the graph increasing faster.

Compound Interest

In the bank guaranteed investment certificate (GIC) example earlier in the section, we encountered compound interest. Typically bank accounts and other savings instruments in which earnings are reinvested, such as mutual funds and retirement accounts, utilize compound interest. The term compounding comes from the behaviour that interest is earned not on the original value, but on the accumulated value of the account.

In the example from earlier, the interest was compounded monthly, so we took the annual interest rate, usually called the nominal rate or annual percentage rate (APR) and divided by 12, the number of compounds in a year, to find the monthly interest. The exponent was then measured in months.

Generalizing this, we can form a general formula for compound interest. If the APR is written in decimal form as r, and there are k compounding periods per year, then the interest per compounding period will be r/k. Likewise, if we are interested in the value after t years, then there will be kt compounding periods in that time.

Compound Interest Formula:

Compound Interest can be calculated using the formula:

![]()

Where:

- A(t) is the account value

- t is measured in years

- a is the starting amount of the account, often called the principal

- r is the annual percentage rate (APR), also called the nominal rate

- k is the number of compounding periods in one year

Example 4.1.8

If you invest $3,000 in an investment account paying 3% interest compounded quarterly, how much will the account be worth in 10 years?

Since we are starting with $3000, a = 3000.

Our interest rate is 3%, so r = 0.03.

Since we are compounding quarterly, we are compounding 4 times per year, so k = 4.

We want to know the value of the account in 10 years, so we are looking for A(10), the value when t = 10.

![]()

The account will be worth $4045.05 in 10 years.

Example 4.1.9

A Registered Education Savings Plan (RESP) is a post-secondary education savings plan in which parents can invest money to pay for their children’s later college or university tuition, and the account grows tax free. If Lily wants to set up an RESP account for her daughter, wants the account to grow to $40,000 over 18 years, and believes the account will earn 6% compounded semi-annually (twice a year), how much will Lily need to invest in the account now?

Since the account is earning 6%, r = 0.06.

Since interest is compounded twice a year, k = 2.

In this problem, we don’t know how much we are starting with, so we will be solving for a, the initial amount needed. We do know we want the end amount to be $40,000, so we will be looking for the value of a so that A(18) = 40,000.

![]()

![]()

![]()

Lily will need to invest $13,801 to have $40,000 in 18 years.

A Limit to Compounding

Because of compounding throughout the year, with compound interest the actual increase in a year is more than the annual percentage rate. If $1,000 were invested at 10%, the table below shows the value after 1 year at different compounding frequencies:

| Frequency | Value after 1 year |

| Annually | $1100 |

| Semiannually | $1102.50 |

| Quarterly | $1103.81 |

| Monthly | $1104.71 |

| Daily | $1105.16 |

The amount we earn increases as we increase the compounding frequency. Notice, though, that the increase from annual to semi-annual compounding is larger than the increase from monthly to daily compounding. This might lead us to believe that although increasing the frequency of compounding will increase our result, there is an upper limit to this process.

To see this, let us examine the value of $1 invested at 100% interest for 1 year.

| Frequency | Value |

| Annually | $2 |

| Semiannually | $2.25 |

| Quarterly | $2.441406 |

| Monthly | $2.613035 |

| Daily | $2.714567 |

| Hourly | $2.718127 |

| Once per minute | $2.718279 |

| Once per second | $2.718282 |

These values do indeed appear to be approaching an upper limit. This value ends up being so important that it gets represented by its own letter, much like how π represents a number.

Euler’s Number: e is the letter used to represent the value that ![]() approaches as k gets big.

approaches as k gets big.

e ≈ 2.718282

Because e is often used as the base of an exponential, most scientific calculators have a button that can calculate powers of e, usually labeled ex. Some computer software instead defines a function exp(x), where exp(x) = ex. Because e arises when the time between compounds becomes very small, e allows us to define continuous growth and allows us to define a new toolkit function, f(x) = ex .

Continuous Growth Formula:

Continuous Growth can be calculated using the formula:

f(x) = aerx

Where:

- a is the starting amount

- r is the continuous growth rate

This type of equation is commonly used when describing quantities that change more or less continuously, like chemical reactions, growth of large populations, and radioactive decay.

Example 4.1.10

Radon-222 decays at a continuous rate of 17.3% per day. How much will 100mg of Radon-222 decay to in 3 days?

Since we are given a continuous decay rate, we use the continuous growth formula. Since the substance is decaying, we know the growth rate will be negative: r = -0.173.

f(3) = 100e-0.173(3) ≈ 59.512 mg of Radon-222 will remain.

Practice questions

1. Suppose a company had 50 workplace accidents in 2012, and the number of reported accidents increased to 175 by 2018. If the number of accidents grew exponentially, what was the annual growth rate?

2. Looking at these two equations that represent the balance in two different savings accounts, which account is growing faster, and which account will have a higher balance after 3 years?

![]()

![]()

3. A population of 1000 is decreasing 3% each year. Find the population in 30 years.

4. Recalculate Example 4.1.8 with monthly compounding.

5. The population of a nest of ants is 225, with a continuous growth rate of 18% per week. What is the population size of the nest after 8 weeks?

6. You are told that your 42 year-old hockey card is worth $1200. If this card appreciated at 19% per year compounded semi-annually, what was the initial value of the card?