PART I/THE PRESENT: WHY CANADA HASN’T MADE GLOBAL TV HITS

CHAPTER 3

FOLLOW THE MONEY

“It’s funny. I haven’t been contacted by Canadians. No network has contacted me directly and said ‘Why don’t you come in for a meeting?’ There’s no courting. Here, the agents are all over you. When I have been approached by Canadians through my agent, it always begins with ‘I’m guessing he’s not available.’ Canadians apologize for everything. Stop apologizing. Call me and say you have a great fucking project. I use the curse word because that’s what my agent would say: ‘Great fucking project. You want to do it?’ Don’t be Canadian. Come at me hard. Sell me. Court me.”

Powerful themes emerged from my conversations with Canadian TV professionals. Award-winning producers observed that the popularity problem is systemic and structural. Executives worried that the system is encouraging mediocrity. Development was called pretend, warped, and broken. Hollywood executives said they would never work in Canada again and asserted that the DNA of the system has to change. In my search for an analytic paradigm to pull together these observations, I found guidance in two more quotes from Albert Einstein. The first underscores the importance of theory: “It is the theory that decides what can be observed.” The second, seemingly an interpretation of the problem solving principle of Occam’s razor, warns that a chosen theory should be easy to understand: “Everything should be made as simple as possible but not simpler.”57

Value chain theory meets both needs because it is both revealing and simple. Value chain analysis, in the most general terms, means following the money. Ultimately, this approach delivered frame-breaking causality for Canadian prime time TV’s poor market performance. Value chain analysis proved why Canada’s aging policy framework has been so vulnerable to the decline of its three financial pillars: Geographic monetization, linear broadcasting distribution and cable delivery. It explained why Canada hasn’t made prime time TV hits and makes the case for nothing less than structural change, not tweaks to the outdated framework. Ultimately value chain analysis led to the design of an actionable policy path forward, as set forth in the last chapter. This chapter takes you through my value chain analysis of Canadian prime time TV and how it is further informed by comparisons to the value chains of Hollywood and YouTube. These two very different models each deliver content that is popular on the world stage. This is because both have value chains that prioritize the same thing: audience.

One more thing before we dig in: value chain theory proved my initial hypothesis wrong. I had suspected the popularity problem would be rooted in weak creative, but it is not. Canada is teeming with talented producers, writers, and development executives. Value chain analysis demonstrates that it is the flow of money that determines outcome. The alignment of financial elements is what pressures creative development to be the best it can be, and thus determines market performance. Value chain analysis allowed me to pull together hundreds of disparate field observations into a singular takeaway: financial elements determine creative elements, not vice versa.

Defining terms: Value chain, disruption, value migration

Following the money in the TV value chain required synthesis of three Harvard-based conceptualizations: value chain, disruption, and value migration.

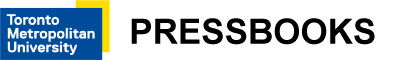

Michael E. Porter is credited with conceptualizing value chain58 as a linear sequence of business activity that results in delivering a product or service to market. Value is defined economically, such that the cost of inputs is less than outputs. Implicit in a value chain is the primacy of customer demand as the determinant of value. A generic value chain progresses linearly from research and development of an asset (R&D), to manufacturing the asset, to return on investment (ROI). Per the figure below, TV content maps well onto these three phases. Development is R&D. Production (manufacturing) is the middle. ROI includes marketing, sales, and all forms of distribution and monetization.

Clayton Christensen extended the concept of a value chain to respond to market disruption with a method he called “breathtaking simple:” value chain evolution (VCE).59 Simplicity derives from VCE’s straightforward strategy to examine the extant value chain, decide where value is shifting, and make organizational decisions to compete and capture value where it has shifted. Well before Netflix, Christensen observed that a common pattern for disruptors is to enter an underserved market. As cash flow increases with customer volume, a start-up tends to move up market to capture incumbents’ customers by delivering the benefits demanded at the higher-end.

Adrian Slywotzky proposed the term value migration to refer to the process of shifting value during disruptive times. More than a decade before the TV disruption, he observed that value can continuously be captured only by responding to customers’ changing priorities. The shift to online TV aligns with Slywotzky’s three phases of value migration: inflow, stability, outflow. These categories also relate to traditional nomenclature for business stages: infancy, maturity, decline. A problem is that the pace of value outflow accelerates as the extant value chain becomes increasingly obsolete, often surprising incumbents:

“As an organization becomes more successful in the value-inflow stage, institutional memory is built… Although customers begin defecting, opting for new business designs, warning signals from the marketplace rarely penetrate an organization’s protective layers. And if they do, they are met with denial. … The organization’s ability to move is lowest at precisely the moment when the need to move is greatest.”60

No need to succeed

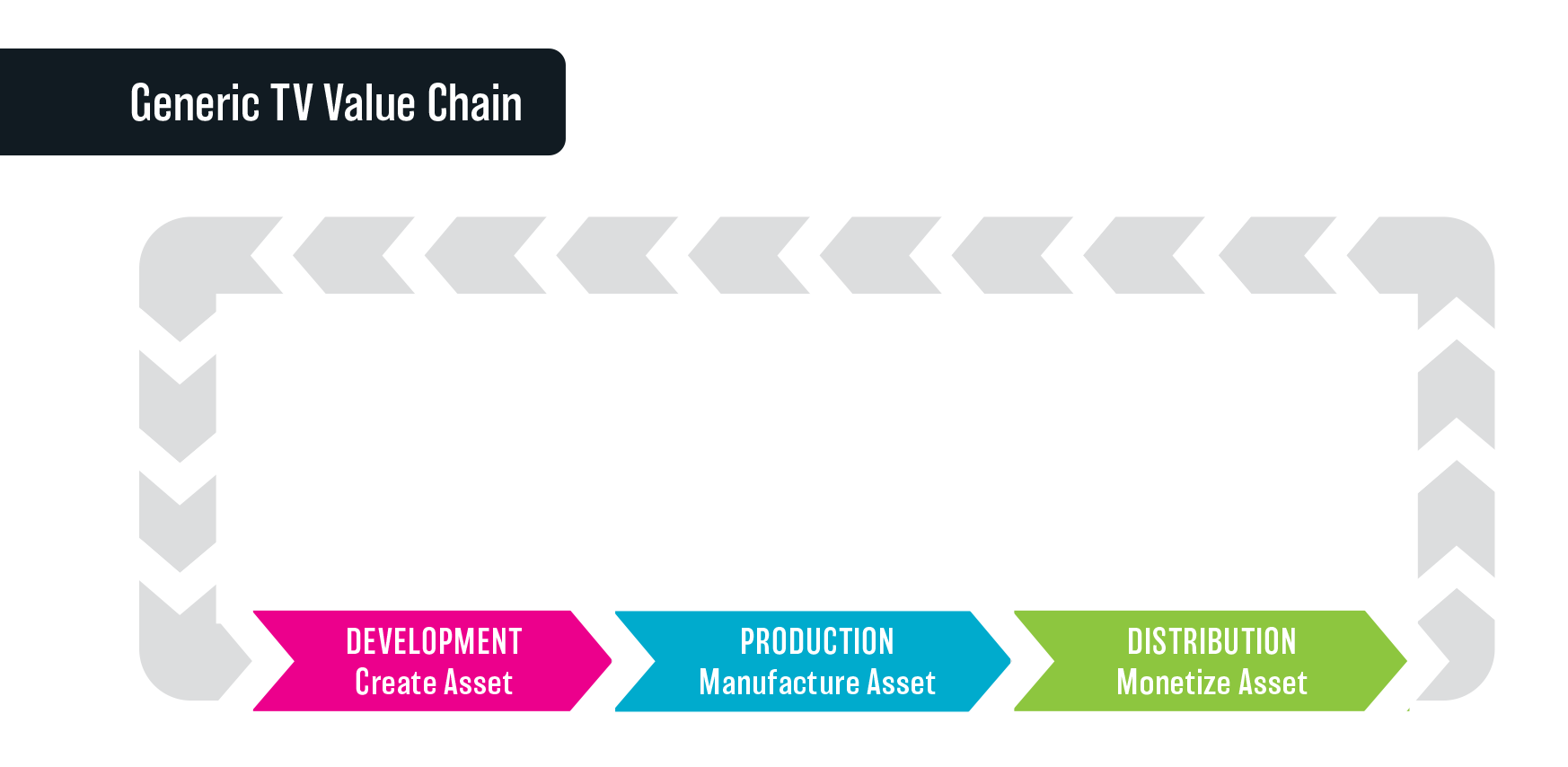

There is little controversy that Hollywood is the epicentre of entertainment TV creation and can be considered the gold standard for best practices for how it’s done. How does Hollywood continue to output popular TV even through historic disruption? What linear sequence of business activities, from development through monetization, has led, so consistently, over 7 decades, to global hits? The Hollywood TV value chain is pictured below. Analysis commences with a consideration of the development phase and moves linearly to production and finally, distribution.

The financial structure of Hollywood TV development usually includes at least two financiers that invest in the project for only one reason: to make money. In return for their investment, financiers secure the right to exploit the finished program. Before online delivery, these financiers often included multiple stakeholders: (1) a domestic distributor that licensed rights to distribute in the U.S. via broadcasting, cable and eventually online; and (2) a studio that purchased the remainder of rights to exploit the global market. There might also be additional financier(s) who make up a financial deficit, known as a shortfall.

As Netflix gained traction and triggered a growing set of competitors in a global streaming market, the Hollywood development financing picture has simplified for some projects. Services such as Netflix, Amazon Prime, HBO, Disney, Apple TV+ and others commission TV and finance a project in exchange for global rights. In this model, geographic rights for individual countries and/or windows for monetization, such as number of broadcasts or a progression from network to specialty TV may not be available. However, this simplification of the value chain doesn’t alter the imperative conclusion, a key observation that warrants repetition. This imperative is that TV commissioning studios invest in the development of TV for the same reason as financiers in other industries: to exploit the asset in order to recoup costs, invest in more R&D, and make a profit. The only way the TV industry thrives is by deploying a portion of profits to finance further development. Given the high risk of development, this works only because of the enormous profits that can result from a single hit, hundreds of millions or even billions of dollars that offset losses for most shows. I can speak from experience. It only takes one pitch meeting in Hollywood to feel the DNA: a relentless need to succeed. I was in a meeting where the only two responses from the executive were a remark to her assistant: “Will it work for our audience?” and a few minutes later: “Sold.”

Close reading of the Hollywood value chain reveals the reason for such clarity of purpose: all development financiers are perfectly aligned in a mutual, singular goal to optimize the asset to maximize its potential for popularity. In Hollywood, hits are not just nice-to-haves, per a Canadian executive: “Yeah it did well.” In Hollywood, they are must-haves: “We won’t sacrifice creative for cost.” Hits are the only way that companies succeed and without them, companies fail. Companies and careers are on the line with every decision. My research made it clear that the same pressure flows downstream to producers and showrunners.

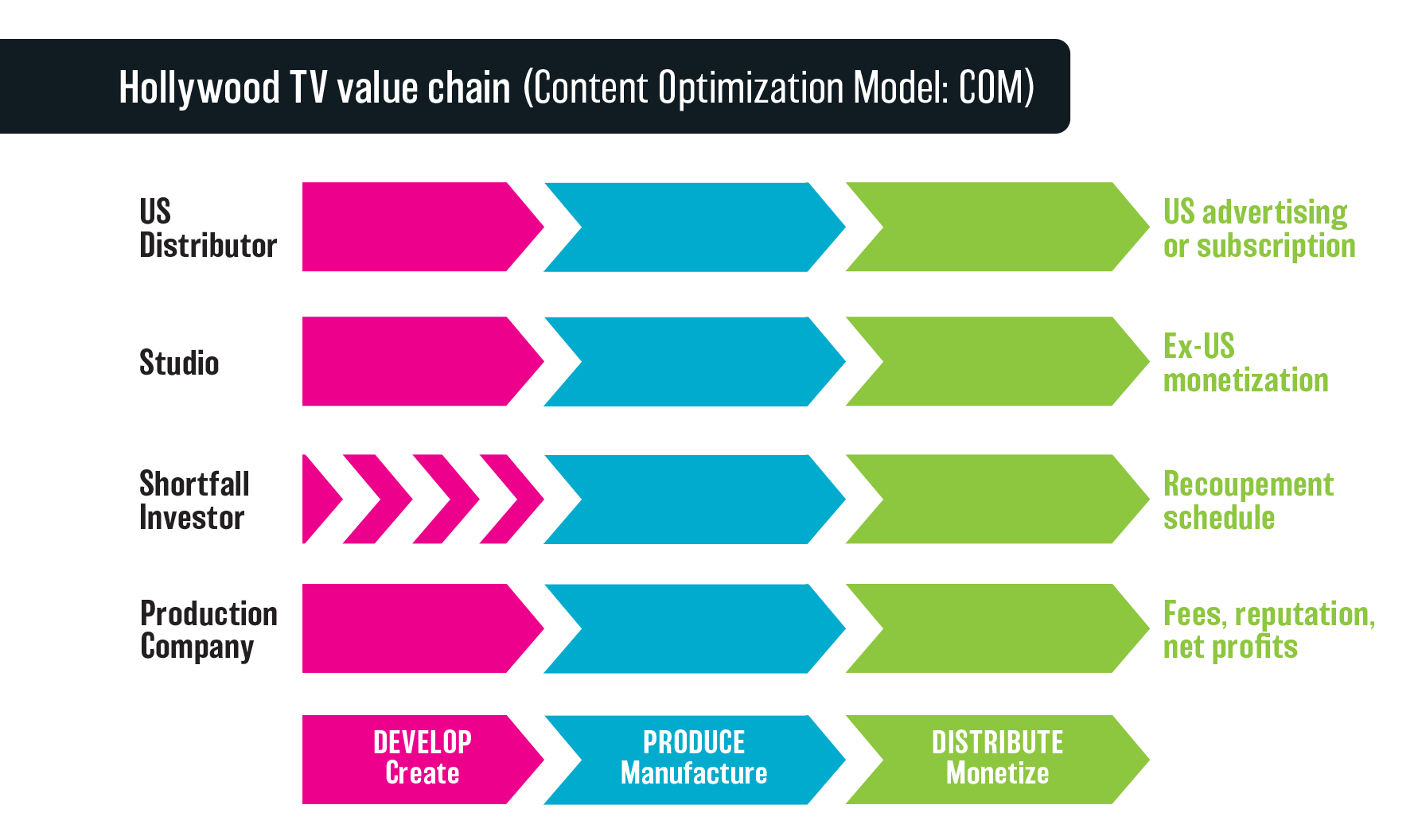

Production is the middle of a TV value chain. When financial and creative elements are approved, the project is greenlit for production and manufacturing begins. Production concludes on delivery and acceptance of the product to the financiers. Compared to phase 1 (R&D) and phase 3 (ROI), production is the least risky of three uber risky phases of making TV. As will be significant in the discussion of Canadian chain, production is also the most discreet and easily outsourced phase. Screen production is a B2B process that has been studied for decades. Movies and TV are produced in more than 200 hundred jurisdictions across the world. Locations vie for the below-the-line production business, which is relatively clean, involves many jobs and enhances tourism. Competing successfully requires cluster capabilities including physical and administrative infrastructure, as well as a specialized labour force including highly-skilled and semi-skilled workers. Despite competition from other production centres, Los Angeles has retained its top ranking in production, in addition to being the world’s top creativity cluster.

The figure shows the production phase of the TV value chain. Intersecting circles emanate outwards, visualizing the idea that production competes in two separate, global competitive sets. One competitive set is comprised of the other locations around the world because TV projects seek the best site to shoot after factoring in costs, infrastructure, administrative, and labour capacities. The second circle signifies another competitive set because TV production labour capacities transfer well to below-the-line jobs in other screen media such as film, digital content, video games, reality TV, children’s and family programming, news, documentary, sports, and advertising. This competitive set represents alternative employment potential for TV production crews and further strengthens employment security for work that is mostly part of the gig economy. It’s critical to observe that neither competitive set for the production phase is causally linked to R&D or ROI. Production is a manufacturing expense that seeks cost-efficiency and quality-sufficiency. Whether or not a show will become a hit is not a priority in the decision of where to shoot.

Distribution is the final phase of the value chain. While involving numerous and evolving business-to-business (B2B) processes, the ultimate goal of distribution is the set of business-to-consumer (B2C) mechanisms of action that constitute monetization. In other words, distribution is where the rubber (content) meets the road (consumers). The success factor is singular: capturing the attention of the largest possible audience. Measuring audience attention has always been the holy grail of distribution because measurement converts audience attention into economic value, whether calculated by ratings, subscriptions, clicks, or a process not yet invented. Distribution has been constantly evolving since TV was invented, but never fully disrupted until digital, online distribution created one global market. What has never changed is its main dynamic: monetization depends on audience popularity.

A value-chain perspective makes it clear that only phase 3 of entertainment TV is in upheaval: it’s a distribution disruption. Netflix’ success awakened sleeping giants and ignited a protracted battle for online TV dominance that is ongoing. The Hollywood value chain makes it easy to understand why pressure for hits was expressed by showrunners working there. Popularity is the chain’s DNA. Popularity impacts how creatives think about stories from the first moment of a pitch until delivery to a financier. In Hollywood, popularity is the river that runs through it.

I call the Hollywood model a Content Optimization Model (COM) because of its emphasis on optimizing the asset in R&D, so as to maximize ROI.

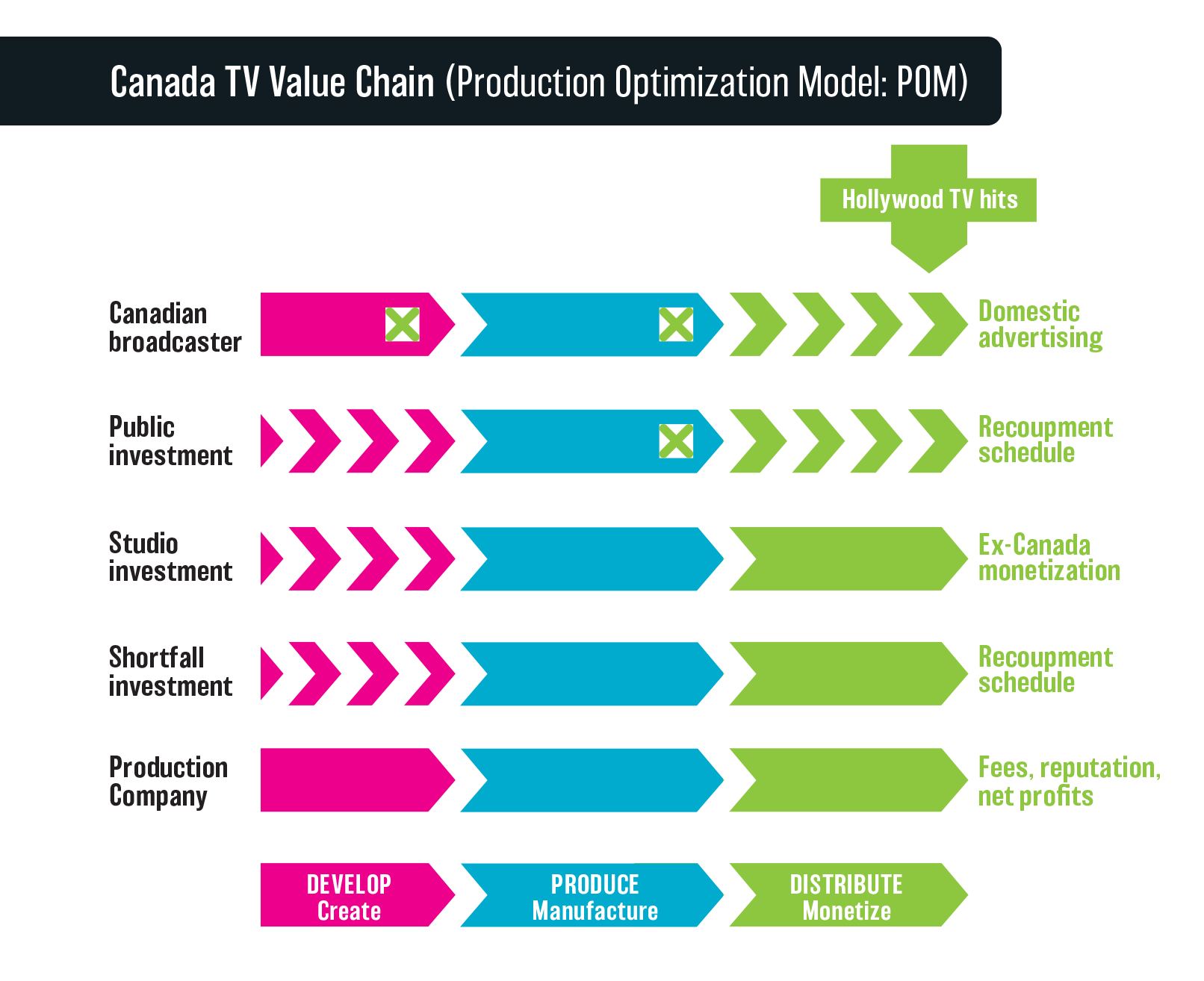

Turning our focus to the Canadian TV value chain, the value chain depiction shows that it exhibits stark differences in both R&D and ROI compared to the Hollywood chain. Like all generic value chains, Canada’s begins with development and progresses linearly to production and lastly, to distribution. The analysis demonstrates that neither popularity nor global reach is necessary to the Canadian value chain, so it is no surprise that the value delivered is not globality. The Canadian design deploys simultaneous substitution as its main profit centre. It demotes the broadcaster’s investment in Canadian TV as the cost of doing the real business: monetizing Hollywood hits.

Before digging in to examine the Canadian TV value chain, a quick, yet important digression. To me, there seems to be an ongoing error in the way that value chain is considered in Canada’s TV industry reports. The mistake may be emblematic of the structural weakness in the policy framework. For example, in the last few years,61 a TV value chain has been pictured in a key report. However, the depiction starts with production, omitting the most critical phase of a TV value chain, development. Across the business ecosystem, R&D is considered the most important phase because it is where an asset is created and optimized so as to yield the most return in ROI. As established, production is the middle of the value chain and is a manufacturing expense that does not link tightly to R&D or ROI. R&D is where customer needs are most keenly considered, and in the case of TV, this means the audience demand for entertainment. R&D is the phase that sets up the asset to fulfill the purpose of the product, i.e. entertainment that will perform well in the largest possible market. By concentrating on optimizing the value of production, this depiction seems implicitly to confirm that the government (meaning the Broadcasting Act as implemented by the CRTC) is the main customer for Canadian TV, not the audience. Omission of R&D seems indicative of the sector’s myopia about how TV value is created and its reliance on the mediaucracy to supply funds — not the market.

Development practices appear superficially similar in Hollywood and Canada, but following the money clarifies that they differ fundamentally regarding what is at stake. Following the money illuminates why the A-list showrunner called Canadian development a “bridge to nowhere,” meaning a dead-end process. In comparison to Hollywood R&D, Canadian development lacks the power of well-aligned, non-overlapping financial partners united in a high-risk, singular goal to create an asset that must succeed in the market. In contrast, Canadian development exhibits a jumble of financial priorities. Per the figure, here’s how it works.

The Canadian broadcaster, the gatekeeper of the public funding, substantially completes their development obligation by simply committing to a licence fee in fulfilment of expenditure quotas (Canadian Production Expenditures/CPE) that are set by CRTC when it renews a broadcasting licence. The obligation to spend a percentage of revenues, about 30%, results in motivating the broadcaster to make the licence fee as high as possible, reduce the number of projects and therefore, minimize management load. This helps explain why licence fees for official Canadian content exceed fair market value, compared to those paid for Hollywood hits. Overpayment is further encouraged by rules stipulating that the licence fee can be as high as one-third of the episode budget, a rule which has zero to do with market value but helps secure production funds for the producers and in return, only secures domestic distribution for the broadcaster.

But it’s even more complicated. Compared to the Hollywood chain, the Canadian broadcaster plays a two-part hybrid role in the policy framework, neither of which incurs risk. The first role is as linear broadcaster, acquiring rights to distribute the program in the geographic market (in this case, all of Canada), similar to any linear broadcaster in Miami, Milan, or Mumbai. However, the Canadian broadcaster incurs no risk in overpaying for these rights, because they don’t need, or expect, to make a profit on the resulting show. The purpose of this expenditure is to fulfil an obligation to invest in Canadian content and thus, keep their licence to broadcast profitable Hollywood hits.

The broadcaster’s second role in development is also compromised. In the absence of a studio system in Canada, the linear broadcaster operates as a quasi-studio who manages the development of the project, including access to public funds. But there are disconnects with the role of a real studio. One is that no ex-Canada rights are acquired in exchange for the super sized investment; they have not even been allowed. Rights to distribute and monetize the show in the U.S. and elsewhere in the world are reserved for (mostly) foreign studios. This structure even further erodes a vested interest in market performance because if the show is a global hit, the broadcaster will not participate in the financial rewards! Secondly, the broadcasters have no intention, or need, to recoup because the expense is expected to be written off as a loss. The sole motive of Hollywood studio investment — to create a hit and be profitable — is MIA from the Canadian development phase of the value chain.

Further evidence of misalignment of the development financing is that most public funds (up to 40% of the production budget) begin to be dispensed at the onset of production and carry minimal risk if not paid back. Unlike a studio, CMF does not risk going broke if the project is not a market success because funds are largely based on production volume. Via cross-subsidy, 5% of cable revenues, which themselves are driven by demand for Hollywood hits, are obligatorily contributed by the cable companies and matched by DCH. Canadian TV financiers are in the “business” of spending money, not making it. Perhaps unsurprisingly, an apparent consequence of this structure is that CMF has a 2% ROI on its funding. The value chain is not designed to deliver ROI value, so it doesn’t. The value chain structure is designed to maximize production spending and it does accomplish this goal. In addition to foreign studios, Canadian producers shoulder much of the risk in making Canadian TV, but are saddled with key financial partners (broadcaster, cable companies, government), none of which has compelling vested interest in the outcome of the Canadian TV development process.

The lack of a need to succeed came through in an anecdote I call “no ringing.” A newby creative produced a show, then needed to keep working:

“After doing a successful Canadian series, I thought: ‘I’m in the business.’ But the phone never rang. No one pursued me. No network called. Six months later there’s nothing. I was like “What am I going to do?” I wanted to stay in Canada, but it was like my show never happened. They forced me to L.A. because there was no work in Canada. The irony was coming to Hollywood after creating and producing a TV series, everyone here was excited about what had been done. There was an energy that blew my brains. I’m still Canadian. I’ve not given up citizenship. I have no intention to.”

No need to succeed leads to no surprise that Canadian networks don’t insist on hiring the best Canadian creatives: they don’t need them. The reasons often stated by broadcasters are cost or unavailability, but neither excuse rings true to A-list Canadians in Hollywood, who said they want to work on Canadian shows. Canada’s networks do have the money; they are owned by multi-billion dollar telecommunication conglomerates that do invest mightily in whatever they need for business growth. Following the money suggests that the real reason that reasonable offers aren’t made is that the financiers have no need to succeed in the original TV business:

“I’ve met with Canadian companies and the talks go very well and then when I see their offer, I’m like ‘You don’t get it, you’re not even in the ballpark. Are you expecting patriotism, because your offer is certainly not based on economics.’ But I don’t feel any inherent prejudice against choosing a Canadian project. I would be very, very open to it.”

There could be additional benefits to employing the best creatives, such as upleveling the system. Several sources expressed worry about insufficient training for Canadian junior writers, training that in Hollywood happens largely in the writing room. A Canadian executive wondered: “Why has there not been the training of a larger group of Canadian writers?” One offered a compelling analysis of a lax approach to getting the script right:

“Are we pushing or guiding our writers enough to understand what they could be capable of or are we accepting less than their best and therefore there’s no incentive to reach the best?”

To summarize, Canadian development is only superficially similar to Hollywood’s, where a financial need to succeed in the market drives the process from first pitch. Canadian development features a misalignment of financial interests in the development phase. It lacks risk and the need to optimize R&D to facilitate recoupment in ROI. To those who have worked in both clusters, Canadian development feels “pretend.”

Moving on to the middle of the chain, Canada’s production sector is a world-class centre of excellence. This is the result of decades of astute policy design and implementation. Canadian production operates in a globally dispersed, multi-billion dollar supply-demand competitive set which has been much explored.63 This strength is widely attributed to proximity to the U.S., including by industry leaders such as CMPA President and CEO, Reynolds Mastin:

“Thanks to our proximity to the US, we have been able to build a very robust production infrastructure in different parts of the country. It’s breadth and depth are quite extraordinary for a country of our size. In many respects, leaving the US aside, we’re the envy of the world in terms of all the levers we have at our disposal.”

Canada was among the first countries to seize the opportunity to make production a free-standing phase of the value chain and lure this so-called runaway business from Hollywood, at first offering financial benefits based on discounted currency. As the workforce and location services improved, demand for Canada as a location for screen production grew. Today, the world-class workforce is backed up by excellent studio and equipment capacity and administrative infrastructure, a triple threat that attracts TV and film productions from all over the world. Strength is today attributable to strong fundamentals, not currency discounts. Early proof was that the sector continued to grow through periods of sustained U.S.-C.A.D. parity such as 2009-2014.64 Further testament to excellence is the 2016 decision by Netflix to open its first studio outside the U.S. in Canada, and again, its 2020 announcement — during the pandemic — of amplified investment in new studio infrastructure in Vancouver. In October 2020, it was announced that Toronto was seeking a developer for a 500,00 square feet of new sound stages in response to increasing demand for Canadian location production.65

Canada’s three production clusters in Ontario, Quebec, and British Columbia account for more than 90% of production volume. Each location tends to specialize in content that aligns with the logic of its geography. British Columbia, on the west coast, in the same time zone as Hollywood, with dramatic scenery and mild weather, attracts most of the Hollywood shoots. Ontario, the financial headquarters of key broadcasters and government agencies, is home to half of Canada’s screenwriters. Ontario specializes in Canadian content. Quebec is the location for most of the French-language productions. The remaining 10% is spread out among production centers in Nova Scotia (3%); Alberta (2%); and 1% or less in the other provinces Newfoundland/Labrador, Manitoba, Saskatchewan, New Brunswick and Prince Edward Island. Taken as a whole, Canada ranks #3 in production volume in North America with the top two spots held respectively by Los Angeles and New York City.

While production doesn’t link to popularity, increasing production volume has been a successful policy strategy that has led to increasing volume and capacity of below-the-line labour. However, a critical observation is that money spent to increase production volume will not increase audience size. Popularity is achieved by storytelling excellence, which is the result of how the R&D phase of the chain is structured and its linkage to the size of the audiences who are reached in ROI.

Turning now to the distribution phase of the Canadian value chain, the overarching point is that the disruption in distribution technology, followed by business model disruption, has destabilized the Canadian TV value chain, as it has around the world.

Linear broadcasting has fallen from its decades long double-digit profitability to 1-2% growth. Both linear broadcasting and cable delivery are in irreversible, terminal decline, similarly to landlines some years back. In the U.S., disruption to online viewing has been a thrilling creative destruction. In Canada the same disruption ignited a three-alarm policy fire that randomly scorched the three financial pillars of Canada’s framework: linear broadcasting, cable delivery, and geographic monetization. Per the depiction of the chain, Hollywood hits are parachuted in, creating a profitable ROI culmination to the Canadian value chain process. Broadcasting profits are derived from the large Canadian audiences for Hollywood hits; these profits deliver the money to cross-subsidize production. Historically, this model has delivered strong ROI, boosted by a regulatory benefit (simultaneous substitution) that is now in its sunset phase because it is part of linear broadcasting. Close examination of the Canadian value chain suggests that absent profits from Hollywood hits, the chain may collapse. Its ROI is disconnected from its R&D, the process that finances the development of an asset. Both identities of the Canadian broadcaster (conventional linear broadcaster and hybrid studio that manages development but doesn’t acquire global rights or have vested interest in the financial success of the assets it develops) are under stress in the global, online era. Following the money in the Canadian TV value chain reveals that the extant structure cannot solve today’s challenge, which is the need for popular content with global reach. Canadian TV policy has not been designed to deliver globality. It has been designed to optimize production.

In contrast to the Hollywood style COM, the Canadian prime time TV value chain, can be called a Production Optimization Model (POM). It’s R&D phase is weak due to misaligned financial interests that lack a need to succeed in ROI. In a global TV market, this structure is a disservice to Canada’s talented, risk-taking creators and producers who deserve financial partners aligned with their need to succeed.

Canadian value chain: Missing linkages

There is more to the analysis. A value chain has more potency than how each of its three key phases add value. The linkages between nodes on the chain also critically impact the value delivered. Two types of broken linkages in the Canadian TV chain further weaken its efficacy to deliver TV hits.

The first and most obvious is that R&D is disconnected from ROI — compared to Hollywood where tight connection between R&D and ROI is the systemic DNA. Hollywood’s tight linkage between R&D and ROI explains why a top showrunner said that attracting an audience of 20 million is uppermost in their mind in a first pitch and why a studio executive asserted that “development is where a show is made or lost.” This contrasts to Canada, where R&D is disconnected to ROI and development was described as a “bridge to nowhere.”

A second type of missing linkage, more nuanced, emerges when probing the implications of the breach between R&D and ROI. I could not initially understand the importance of comments like this one from a showrunner who had just attained the holy grail: renewal. It was one of many that suggested disinterest, even abandonment by the Canadian system, after achieving a hard-won benchmark of success:

“The news we got renewed came yesterday and 20 different companies sent congratulations: ‘When can you come in?’ You know how ideas work. It’s ‘Let’s have a drink and talk, where’s your head at, what are you thinking about lately?’ I haven’t had time to reach out to Canadian networks and they don’t. It is crazy that no Canadian network has ever reached out to me.”

Well into the value chain analysis, I still thought the popularity problem might be attributable to weak creative linkages between Canada and Hollywood, exacerbated by brain drain to Hollywood. Puzzled and needing to go deeper, I used a methodology typical for qualitative research, vacillating between theory and field data, searching for frame-breaking insight. Ultimately, I found causality, not in the creative, but in the money, and thus came to a new view of the role of creative linkages. The linkage problem is not that Canadian creatives leave for increased opportunity in Hollywood. Due to the structure of the value chain, financial gatekeepers simply don’t need to source the best talent available. Of course, in today’s virtual geography, the best writers could easily be vetted and contracted. The problem does not reside with the mobility of the creatives. It’s that Canadian financiers either don’t show up at all or don’t show up with the appropriate money.

Here’s the deal. As financiers, Canadian broadcasters perceive themselves as outsiders to the business venture they are financing. It’s not that they don’t know the necessity of investing money to make money. In the mid 20th century, they invested in broadcasting towers and today they spend millions on commercially viable Canadian sports and lifestyle shows. Moreover, core to the broadcasters’ business is the expenditure of large sums of money for software, i.e. Hollywood hits. Every May (before the pandemic) Canadian executives physically traveled to Hollywood for a week to select upcoming Fall shows. The purpose of this brief presence in Hollywood was not to directly benefit their year-round original Canadian TV development activities in their role as gatekeeper and guardian of the money, but to ensure the steady stream of profits on Hollywood hits. If broadcasters needed to succeed in their original content, a few hundred thousand for a Hollywood-focused development office (virtual or real) or the cost of a top-tier Canadian creator would be a no brainer. Per the current structure, producers shoulder the risk of content development that should be shared by financiers. It is the policy framework itself, more precisely the structure of the value chain — the way the money flows through it — that bears much responsibility for this.

Being MIA in Hollywood also applies to public funders. In the 1990’s, the Los Angeles Canadian consulate kept an updated directory of Canadians in Hollywood to facilitate connections between networks, producers, writers, directors, and actors. It was never digitized and is long defunct. Today, there is no easy way for a producer to find a young, talented Canadian writer working in Hollywood.66 Some financiers from other countries do maintain offices in the world’s leading cluster for creativity, including U.K. broadcasters BBC and ITV; Australian broadcasters Seven, Nine, and Ten; and Korea’s KBS.67 Netflix’ 2021 announcement of a Canadian development office reflects the same logic: The importance of showing up. In today’s complex and evolving ecosystem, whether or not presence is physical or virtual, it’s important for financiers to be present to support Canadian producers who are assembling financing and to help deliver on the relationships and the creative deal making that are essential success factors in making TV. This observation about the TV business is supported by Michael E. Porter, who observed that generally, in the digital, weightless economy, engagement in a cluster becomes more, not less, essential.68 This is because, as more and more tasks are digitized, the creative human work and the business ecosystem become increasingly complex.

To summarize, there are two types of missing linkages in the Canadian TV value chain. A broken linkage between R&D and ROI dulls the motivation to succeed in the market. In turn, this structural fault causes Canadian financiers to have no need to link (physically or virtually) with the best Canadian talent, regardless of where they reside.

YouTube globality: Canada leads the world

I led a collaborative research project that unexpectedly impacted my theory of the case of Canadian TV, specifically the role of popularity. Watchtime Canada: How YouTube connects creators and consumers launched May 2019.69 In the broadest stroke, our report points out that in the 21st century, the dynamics of broadcasting have shifted the problem set for Canada, delivering unintended consequences in the form of a global, online market. YouTube can be considered a living lab that functions as an ongoing experiment about how Canadian creators perform amidst open, global competition. We identified 21 unique value propositions that YouTube contributes to Canadian media and compressed them to one takeaway. I had been so focused on getting the project over the finish line that it wasn’t until I wrote this singular takeaway that I realized the success of Canadians on YouTube has important implications for Canadian legacy TV policy:

“YouTube has facilitated the rise of a new group of Canadian creative entrepreneurs who achieved significant outcomes with respect to diversity, employment, domestic popularity and global export — without requiring the transfer of IP rights and almost entirely without public support.”70

When the report was released, it turned out that I wasn’t alone in observing a connection between YouTube and potential implications for legacy media policy. Here’s Peter Menzies, Senior Fellow McDonald-Laurier Institute and former Vice Chair/President, Telecommunications at CRTC:

“Canada’s creative lobby may have turned its back on the world but that doesn’t mean Canadians are joining them in their quest to hide behind a big wall of regulations aimed at protecting them from foreigners. A recent study by Ryerson University’s Faculty of Communication and Design contains enough data to have progressive thinkers wondering if there’s any need at all for the regulatory ramparts behind which many – but not all – Canadian programmers have huddled for more than two generations.”71

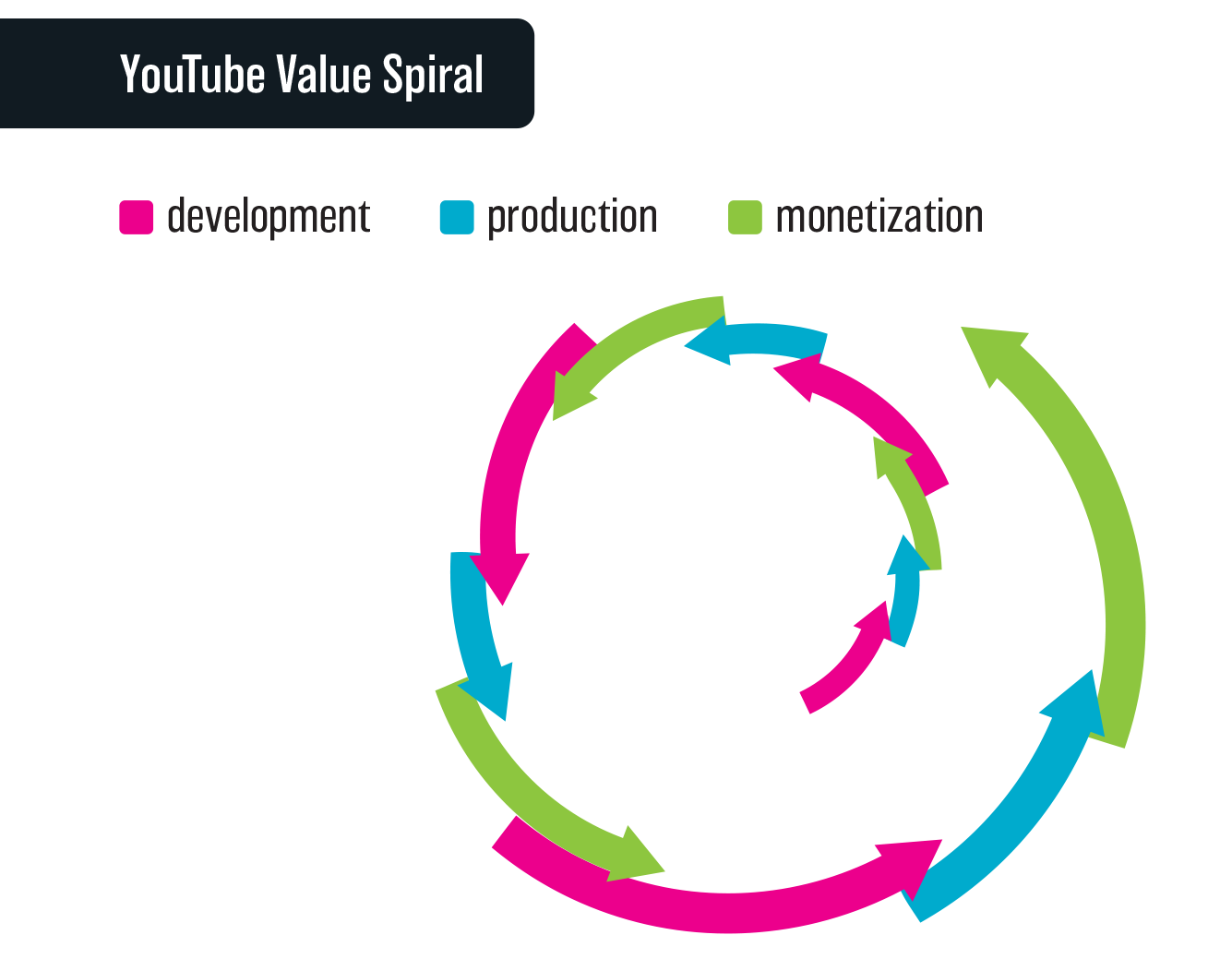

What is the root cause of success by Canadians on YouTube? I examined the YouTube value chain to search for answers. The results lend further gravitas to the claim that financial structure determines creative success, not vice versa. YouTube’s value chain is nearly oppositional to that of Canadian TV; it’s all about the audience. In contrast to weak linkages between R&D and ROI, the YouTube structure intensifies this linkage while collapsing the production phase. It’s not even a value chain; more accurately it’s a value spiral. As creators engage with audiences via instant audience feedback metrics, they respond with new content purposed to increase audiences, which translates to more revenue, and so on.

The YouTube platform is perfectly designed for globality. It’s limitlessly agile, yet relentless, in its response to market demand. Its DNA relies on the monetization of one thing, maximizing audience. Global reach is instant and effortless, requiring one click. YouTube needs its creators to achieve audience popularity — or the platform makes no money. In fact, its advertising supported business model resembles linear TV, but with the differences that revenue is split between creators (55%) and platform (45%); and that audience measurement happens in real time. To support the creators’ and the platform’s mutual need to succeed, YouTube provides creators with free qualitative advice and free, real time, quantitative data. The results are stunning: YouTube is a global popularity contest that Canadian producers are winning.

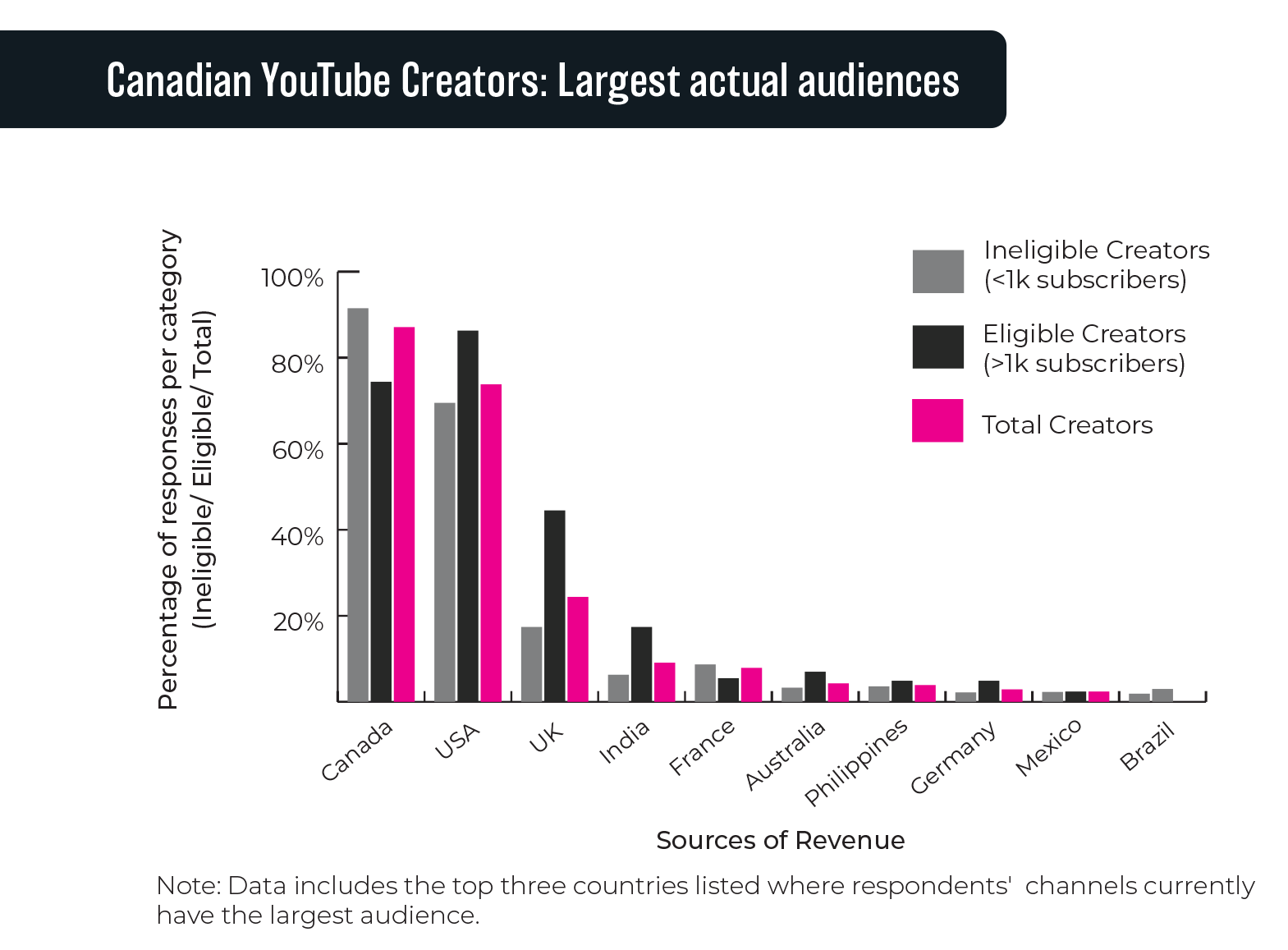

Our study examined the creators’ actual and aspirational audiences. They report that Canadians are their largest audience. Second largest audiences are in the U.S. Canadian YouTube producers leverage their Canadian location to competitive advantage, including their linguistic and cultural proximity to the U.S. It is significant that Canadian creators use the revenues from the large U.S. market to finance more Canadian YouTube content and in doing so, reverse the long-held rhetoric that living next to the U.S. is a media disadvantage. I have framed the necessary transformation for Canadian TV in similar terms: A necessity to transform “from financial dependence on national profits on global content to global profits on national content.”72

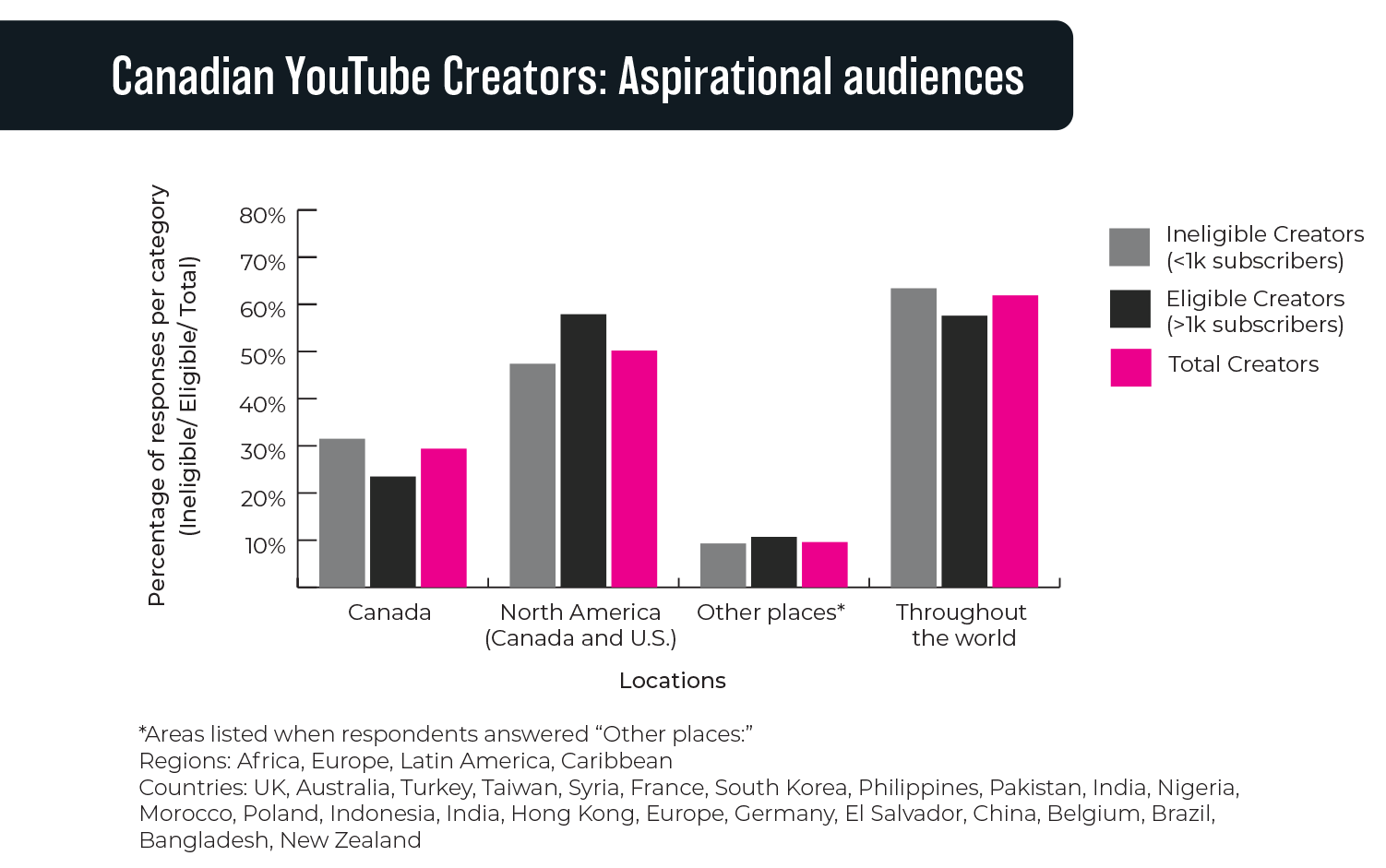

In addition to actual audiences, we also asked Canadian YouTube creators about their aspirational audiences. Most reported that they seek global audiences. Sending this point home is that Canadian YouTube creators actually lead the platform in export, with 90% of views outside the country, compared to the platform’s average of 50%. Canadian creators strongly value YouTube’s free, hassle-free, instant global export feature and said that they would not welcome any policy interference with their unfettered access to global audiences. Here’s a typical response among 9,0000 qualitative data points: “I love using my Canadian creativity to inspire the world.”

|

|

| Source: Berkowitz, I., Davis, C. H., Smith, H. (2019). Watchtime Canada: How YouTube connects creators and consumers, Figures 2.19 and 2.20.73 | |

YouTube’s focus on audience building can be seen most clearly in the data below that demonstrates that audiences are Canadian YouTube’s main priority; this aligns with the priority of top Hollywood showrunners. It is interesting to note that after the twin priorities of making money and growing audiences (the same goal), the next priority of Canadian YouTubers, considering those who are eligible to earn money, is their strategy of how to grow audiences: by making content that inspires their audiences.

We found that Canadian YouTube creators are hit makers who lead the world in every genre on the platform. Many Canadians have audiences in the billions — or merely millions.75 Justin Bieber (20B views – debuted on YouTube); Shawn Mendes (8B – learned to play guitar on YouTube); Lilly Singh (3.2B – comedy); The Weekend (9.3B – music ); Drake (6.8B- music); VanossGaming (12B – gaming); Unbox Therapy (3.3B – tech); Super Simple Songs (17B – kids); WatchMojo (12.8B – infotainment); AsapSCIENCE (1.3B – learning); Vice (2.5B – news); Epic Meal Time (1B – foodtainment); SimplyNailogical(1.5B- comedy-beauty); LaurDIY (1.2B – lifestyle); GigiGorgeous (492M – transgender lifestyle); The Hacksmith (613M – stem learning); FaZe Pamaj (610M – gaming); Molly Burke (130M – blind beauty blog); Aysha Harun (23M – beauty); Walk Off The Earth (818M – music); Amanda Muse (10.3M – lifestyle); The Icing Artist (847M); TheSorryGirls (226M – lifestyle): Peter McKinnon (282M – photography); Home RenoVision DIY (80M – lifestyle); ElleOfTheMills (159M- lifestyle); and so many more. Moreover, naked competition for audiences has resulted in Canadian YouTube creators who are diverse across age, geography, primary language spoken, gender, ethnicity, and physical ability.

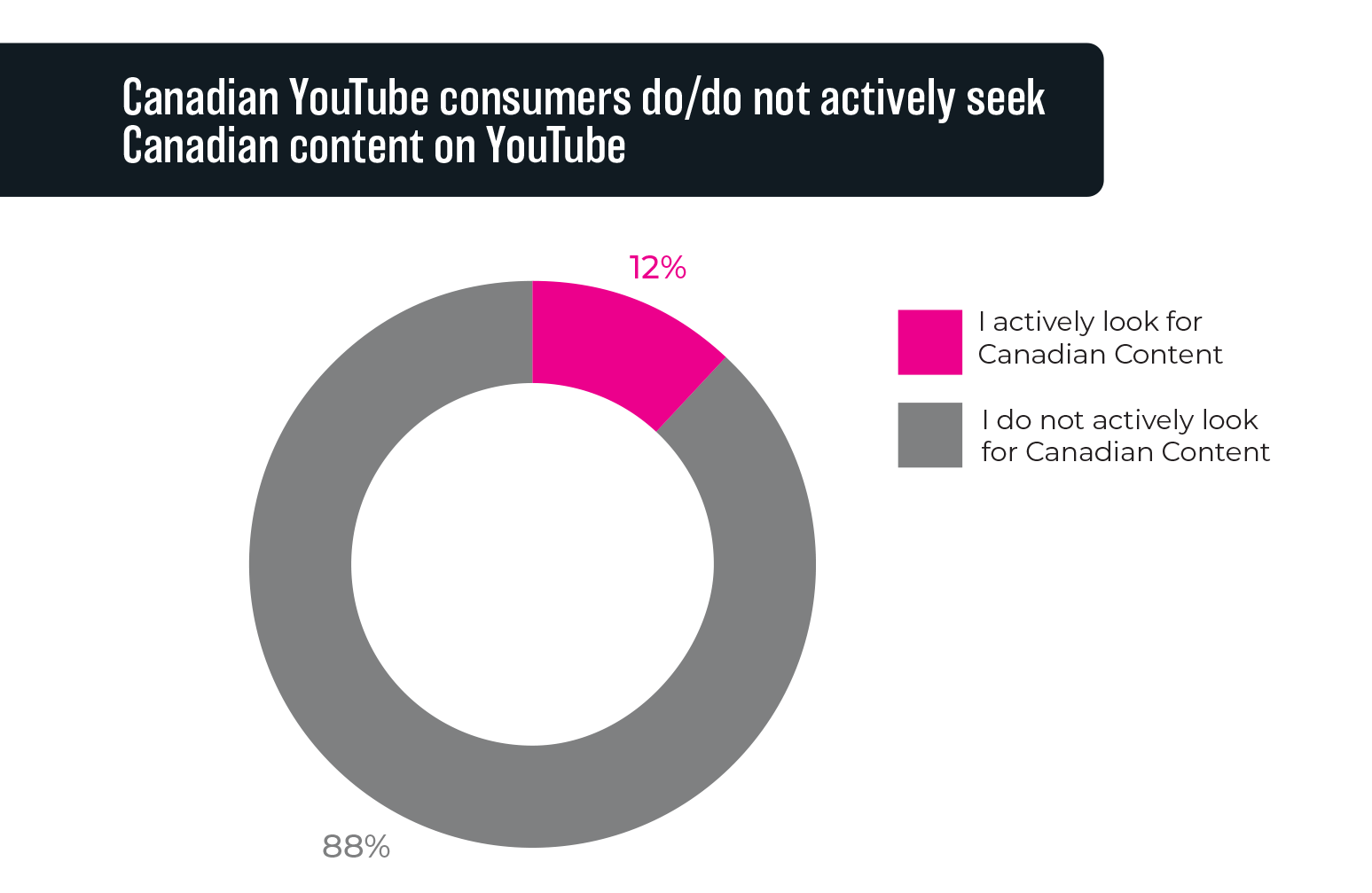

Extensive findings from the audience side comprised the second half of our research. A lurking question was, considering decades of promotion as a policy imperative: Do Canadian consumers care about Canadian content? We could not find any data that directly asked this question for linear TV, but audience attention during prime time suggests they don’t: 90% of Canadians are watching Hollywood hits. Responses from the Canadian YouTube audience were decisive: 90% of YouTube consumers don’t search for Canadian content on YouTube. Filtering the data for age and primary language spoken, there was no difference in the results. Canadians love that YouTube leaps the nation’s media walled garden, with typical responses such as “We live in a global world; why restrict yourself to one part of it?”

Production Optimization Model (POM) to Content Optimization Model (COM) The value of this case study comparison between YouTube and legacy TV is clarity that YouTube’s DNA is most similar to Hollywood’s, i.e. a Content Optimization Model (COM) with a globality DNA. This is to say that, to thrive, YouTube needs must-see content and popularity with large audiences. The YouTube value spiral, with its tight linkages between R&D and ROI, strengthened my theory that tweaking a Production Optimization Model (POM) will not deliver global applause for Canadian long-form TV.

Policy transformation for the globality era will require shifting from a Production Optimization Model (POM) towards a Content Optimization Model (COM).

In closing this chapter, here’s a quick anecdote about my 97 year old Father, a former rocket and airplane engine designer. When I described the Canadian TV problem to my engineer Dad, he looked puzzled: “You mean they made a product that didn’t work in the market and continued doing it the same way for 50 years?” Dad’s response seemed to sum it up. Three value chain analyses — Canada, Hollywood, YouTube — fit Einstein’s words that began this chapter, i.e. that theory determines what is observed and such theory be as simple as possible, but not too simple. Value chain theory has demonstrated, in an accessible manner, that Canada’s POM has native structural faults that mute market performance. In contrast, the Hollywood and YouTube COMs create value in one way: audience. When it comes to future-proofing Canadian TV policy for the global, online era, adjusting the structure of the value chain is problem #1. There is no problem #2.