Part 2: Pop-Up Shops and Stakeholders

Chapter 5: Consumer Segments and Psychographics

Chapter Overview

As temporary retail operations that are designed to fulfill a time-sensitive need in the marketplace, pop-up shops have a short window of opportunity to attract their target customers. These customers have specific needs and wants and are looking for a unique experience in a lifestyle-branded environment. To stay competitive in today’s challenging retail market, pop-up shops need to deliver a welcoming shopping environment that resonates with their customers.

To gain insights into the core values of their customers, retailers can consider the use of market segmentation when planning their retail mix strategy. Market segmentation helps pop-up retailers understand who their customers are, what they do and how they think.

This chapter gives you a helicopter overview of the various consumer segments that exist in our society. You will also learn how pop-up retailers adjust their retail mix by leveraging their understanding of consumers’ psychographic profiles.

Learning Objectives

Upon completion of the chapter, readers will be able to:

- Define characteristics of consumer segments.

- Analyze the psychographics and behaviours of the ideal pop-up consumer.

- Assess which pop-up format best aligns with different pop-up consumers.

Setting the Context

VIDEO

The following video helps to offer some context to thinking about different consumer segments.

In this scene, two students are speaking in class as one plans to open a pop-up shop to sell her original jewelry designs for a very specific demographic – expectant mothers with a taste for French culture. They discuss how to determine if such a market exists in their city and if so, how to reach those customers.

1. Consumer Segments

1.1 Demographic Segmentation

As more and more consumers move their shopping activities online, shopping malls and department stores are seeing less foot traffic. With online retail creating a choice overload, some consumers have found the distinctive products and shopping experience delivered by pop-ups to be valuable as they start to appreciate the curated retail concepts.

Instead of aiming to serve everybody in the market, targeting a particular group of consumers can be beneficial to pop-ups. The demographic segmentation approach uses demographics (identifiable and measurable population data) to group customers based on their age, gender, ethnicity, income and other statistical aspects of populations.

Table 5.1 Examples of Demographic Segmentation

| Demographics | Questions to be considered by pop-up retailers |

| Age | What are the prime age groups of the target market? |

| Gender | Is the target market male, female or members of the LGBT2QS community? |

| Ethnicity | Does the target market cover a distinctive ethnic group? |

| Income | What is the income level of the target market? Can they afford the planned products or services? |

| Household size | What is the household size of the target market? |

| Marital and family status | Is the target market single or married? Do they have children or parents to look after? |

| Employment status | Do they have full-time jobs, part-time jobs or are they in a career transition? |

| Occupation | In what industries are people in the area working? Are they mostly blue-collar or white-collar workers? |

| Education | Are they college or university-educated? |

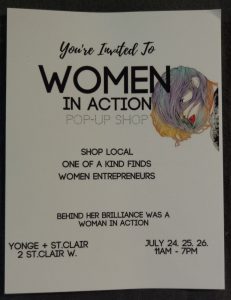

For example, a pop-up shop called “Women in Action” in the Yonge and St. Clair neighbourhood in Toronto (see Figures 5.1 & 5.2) brings together female merchants and customers who may share similar interests. This retailing approach not only allows merchants to source more relevant products for their target market, but also encourages customers to interact directly with the merchants who are often the brand owners or creators.

Did You Know?

- According to Statistics Canada, immigrants made up 20.7% of Canada’s population in 2011. This figure is estimated to reach as high as 30% in 2036, with more than half immigrating from Asia.1

- The 2016 Census revealed that the Prairies were the only provinces where there were more people aged 15 to 34, often referred to as Millennials, than Baby Boomers (aged 51 to 70).2

- Japan has the oldest population in the world, with one in four people 65 years of age and older.2

In Canada, ethnocultural diversity is increasing. Chinese and South Asian immigrants continue to be the two largest visible minority groups, while Koreans, West Asians and Arabs are the fastest growing ethnic groups in Canadian society. Pop-ups can leverage this demographic change and cater to the needs of these consumer segments3 by offering certain types of ethnic foods in locations where there might be a high demand for such products.

Other commonly used demographic segmentation approaches include grouping consumers based on their year of birth4 and age5 (see Tables 5.2 & 5.3). Pop-ups selling to the Greatest Generation and Baby Boomer segments should adjust their retail mix to ensure these consumers are welcome in their senior-friendly shops. For example, these pop-ups may need to arrange talkative employees who have the patience to serve the elderly and make sure signs are printed in large font size to increase readability.

Table 5.2 Consumer Segments by Year of Birth4

| Segment | Year of birth | Age (in 2018, they are…) |

| The Greatest Generation | Prior to 1946 | Older than 72 |

| Baby Boomers | 1946-1965 | 53-72 years old |

| Generation X | 1966-1980 | 38-52 years old |

| Generation Y (a.k.a. Millennials) | 1981-1995 | 23-37 years old |

| Generation Z (a.k.a. iGenerations) | 1996 to present | Younger than 23 |

Table 5.3 Consumer Segments by Age5

| Segment | Age |

| Children and Tweens | 6-12 years old |

| Young Adults | 19-34 years old |

| Sterling Silver Seniors | 65-84 years old |

1.2 The Millennials

While traditional bricks-and-mortar stores may want to target Baby Boomers who have disposable income, pop-ups may want to pay attention to Generation Y, also known as the Millennials, who were born between 1981 and 1995. This consumer segment has gained retailers’ attention because Millennials tend to be independent, confident, tech-savvy and have a strong sense of community (both local and global). This consumer profile fits particularly well with pop-up shops that are selling locally-made or eco-friendly products. Unlike other consumer segments, Millennials particularly want to shop for both experiences and products.

Boston Consulting Group has suggested that Millennials can be further divided into six distinct segments (see Table 5.4)6. Pop-ups that sell green products (e.g., eco-friendly detergent) can target the “Hip-ennial” and the “Clean and Green Millennial” who care about the environment. Shops that sell unique, premium goods (e.g., handmade leather bags) can target the “Millennial Moms” who are wealthy and highly social. Meanwhile, those pop-ups that promote high tech products (e.g., smartphones) can target the “Gadget Guru” who have greatest device ownership. Local, smaller pop-ups selling traditional goods (e.g., clothes) can target the “Old-School Millennial” who like to socialize in a face-to-face manner.

Table 5.4 The Six Millennials Segments6

| Segments | Traits |

| Hip-ennial (29%) | “I can make the world a better place.”

|

| Millennial Mom (22%) | “I love to work out, travel and pamper my baby.”

|

| Anti-Millennial (16%) | “I’m too busy taking care of my business and my family to worry about much else.”

|

| Gadget Guru (13%) | “It’s a great day to be me.”

|

| Clean and Green Millennial (10%) | “I take care of myself and the world around me.”

|

| Old-School Millennial (10%) | “Connecting on Facebook is too impersonal, let’s meet up for coffee instead!”

|

Example

To target youthful demographics, iHeartRadio toured American universities and colleges with its social media vending machine in a pop-up campaign. Students and staff who visited the pop-up could receive free T-shirts or sunglasses from the vending machine, when they shared their love for iHeartRadio by posting on Instagram, using the #iHeartRadio hashtag followed by a four digit code displayed on the vending machine.

Appealing to the Millennial mindset, this innovative vending machine helps brands like iHeartRadio to create an unforgettable retailing experience. The campaign was a great success, the radio station garnered over 5.7 million impressions (likes, shares and views), during the first seven days of this five week campaign.7

1.3 Four Major Social Consumer Segments

Without a doubt, pop-ups can make use of social media to generate buzz and collect feedback from their fans and customers. The conversation on social media has shifted from growing fans and followers, to driving real engagement and business values. Consulting firm The Incyte Group proposes that there are four major consumer segments that are most likely to look to customer communities, especially social media, when making purchasing decisions. Having a good understanding of these social consumer segments allows pop-up retailers to fine tune their target market, develop the right marketing messages, and leverage their social media strategy to nurture a long-term customer relationship. The four major social consumer segments are:

- Fashionista Professionals

- Web-Building Techies

- Bargain-Hunting Mamas

- Knights with Shiny iMacs8

Table 5.5 Four Major Types of Social Media Users8

| Segments | Traits |

| Fashionista Professionals (26%) | Female professionals aged 25-34.

|

| Web-Building Techies (16%) | Male aged 21-24.

|

| Bargain-Hunting Mamas (14%) | Female, often mothers, aged 35-44.

|

| Knights with Shiny iMacs (9%) | Male professionals aged 24-35.

|

Fashionista Professionals

The “Fashionista Professionals” are important to pop-ups selling luxury or niche products because this group of consumers has high purchasing power and sheer segment size. They are powerful because of their social connections and ability to share information. Pop-up shops can consider giving them special offers and promotions, and also creating active online communities for easy social sharing.

Web-Building Techies

If brands are looking for advocates, the “Web-Building Techies” become important because these young men like to spread news among fellow techies, assuming the pop-ups offer them insider information or exclusive incentives.

Bargain-Hunting Mamas

For pop-ups that sell mass-market, branded products or services, they can target the “Bargain-Hunting Mamas” by providing them with special offers or coupons. These consumers are eager to join online communities, participate in research topics and share their knowledge and views about the brand.

Knights With Shiny iMacs

The “Knights With Shiny iMacs” can be valuable to pop-up shops, especially when the shops are selling highly technological, complicated products that may be difficult to use. These male professionals are willing to share their product expertise and offer generous support to other customers.

2. Psychographics of Pop-Up Retail Customers

2.1 Understanding Consumers’ Lifestyle Profiles

In addition to demographic segmentation, pop-ups can also group their customers by psychographic analysis — a process that reveals details about consumers’ lifestyles. It involves the use of quantitative methods such as surveys to understand consumers’ activities, interests and opinions.9

Some consumers may prefer to buy the same brand, at the same retail chain and at the same location. However, there are others who like to try out new brands and shop with new vendors in unexpected places.10 Consumers are becoming eager for new experiences and originality. Many are looking for excitement and are willing to pay a premium for trendy goods and services. By having a thorough understanding of consumers’ lifestyle profiles, pop-up shops can better serve their target market through adjustment in their retail mix. They can also explore the possibility of serving the unserved and under-served market segments (e.g., the LGBT2QS community), by providing them with products or service that are not widely available from traditional retail channels.

2.2 The “Buy Local” Movement

Traditional retail formats such as supermarkets and department stores have the upper hand in selling national brands and private labels due to their economies of scale in sourcing. They can sell a broad range of products at highly competitive prices. However, that does not mean smaller pop-up shops cannot compete in the marketplace. Consumers want a remedy to the homogenization of choices offered by national retail chains. In recent years, many people have started turning to pop-up shops to look for locally made products due to economic and environmental movements. Consumers are interested in having unique shopping experiences that are less routine and monotonous.11 At pop-up shops, consumers often have the opportunity to interact personally with a brand and its creator. Being able to establish relationships with the faces behind the product can be satisfactory to some consumers.

2.3 Consumer Innovativeness and Shopping Enjoyment

Prior research has examined the consumer psychographic characteristics that positively affect the behavioural intentions of pop-up retail. It has been found that pop-up is an effective retail format for marketing to those who consider shopping to be an enjoyable activity and demonstrate high levels of consumer innovativeness.

In general, innovative consumers not only exhibit a need for novelty and uniqueness, but also derive enjoyment from checking information, discovering facts and examining product attributes in their decision-making processes. These consumers prefer self-guided exploration rather than being served by pushy sales staff.

Innovative consumers are more likely to appreciate more of the positive hedonic aspects of pop-up stores, such as friendly employees, impressive decor, pleasant emotions, exposure to new and unique products and the excitement of the pop-up shop experience. Consumers with higher innovativeness and shopping enjoyment demonstrate a more positive attitude toward pop-up retail, considering it to be “good, appealing, interesting, and pleasant”. To target the innovative consumers, pop-ups can also utilize vacant storefronts in mixed-use neighbourhood as the unique location can give sensory stimulation to this consumer segment.12

If retailers can address consumers’ expectations for new and unique shopping experiences, products and services through pop-up shops, they can affect longer-term attitudes, intentions and loyalty toward their brands.13

An example can be seen from Zvelle, a Toronto-based shoe brand founded by entrepreneur and designer Elle AyoubZadeh.14 When the shoe company was founded initially, Elle sold women’s shoes exclusively online. Although her shoes received international recognition, with celebrities and government officials wearing them, Elle soon realized that her customers were interested in touching her shoes, talking to her knowledgeable sales associates and most importantly, experiencing her brand in person. Elle opened up a pop-up shop in Toronto’s Eaton Centre and subsequently another one at Yorkdale.

3. Aligning Pop-up Shops With Consumer Segments

3.1 A Wide Range of Shops

There are many pop-up options that one can consider: a table in a flea market, a booth in a shopping mall, an empty storefront, a section in a department store, a warehouse and many others. The choice depends on many factors, such as business objectives, brand positioning, budget, and the kind of shoppers it wants to target. For example, a Nordstrom warehouse sale (see Figure 5.5) may attract the Bargain-Hunting Mamas but not necessarily the web-building techies. On the other hand, pop-up shop can be the ideal place for relationship building with customers. Brands that target the millennials, especially the Hip-ennial who are information hungry and the Millennial Mom who are highly social, should focus on offering consumers a unique shopping experience rather than facilitating purchase decisions.

Since pop-ups are short-term establishments without a long lease, manufacturing brands can make use of these pop-ups to do a wide variety of things. They can verify whether certain retail concepts will work in a given geographic area and continue to adjust until the right concept is found. Pop-ups can be used to test market reaction to the brand’s product offerings, store design and location. For example, Judith & Charles opened up a pop-up shop in Yorkdale Shopping Mall in Toronto to see if a long-term presence in this upscale shopping mall was warranted.

Example

Fashiontruck Canada is a boutique on wheels that was launched in March 2014.

3.2 Launching New Products in the Mass Market

Not all pop-ups are established to facilitate sales transactions. Some are created by manufacturing brands to promote their new product or service offerings. The Korean electronic giant Samsung built a number of pop-up “experience centres” in the major metropolitan areas around the world to showcase their latest innovations to the public. For example, in Hong Kong, Samsung purposefully built a temporary, time-limited pop-up shop outside a busy shopping centre to support the launch of its Galaxy S8 series smartphone. Not only could visitors experience the smartphones themselves, but they could also speak directly to the brand evangelists to learn about the phone’s advanced features. Samsung was not targeting a particular consumer segment for this launch, so they chose to locate the pop-up shop in a prime downtown location to maximize foot traffic.

3.3 Performing Brand Reinforcement in the Target Market

Another use of pop-ups is to reinforce a company’s brand image in its target market. For example, in Korea, the online game League of Legends chose to set up a pop-up shop in front of U-PLEX, which is a shopping centre that targets the same 18-24 age group consumer segment. Visitors could play games in the shop and receive gifts that bear the League of Legends logo. The selection of shop location, combined with relevant shop activities, helped the software game developer to keep its target market excited about the League of Legends online game.

3.4 Providing Temporary Service

Retailers can make good use of pop-up shops to provide temporary service to their customers when their flagship locations are closed due to renovations or relocation. When the Canadian bookstore chain Indigo was constructing its new “IndigoSprite” flagship store at the Scarborough Town Centre, it opened up a smaller “Indigopop-up” shop nearby to sell a limited selection of books and accessories. Similarly, when the Toronto Public Library’s North York branch underwent a year-long renovation in 2017, it opened a pop-up library nearby in the mall-level of North York Centre so people in the community could still access library resources.

3.4 Increasing Foot Traffic with the Store-in-Store Concept

As more and more consumers are interested in smaller brands and locally-made products, department stores such as Target in the United States opened pop-ups within their stores to attract shoppers. In 2013, Target invited independent designers to sell their goods at a designated area called “The Shops at Target” which appeared in over 100 Target stores throughout North America.

In Canada, the idea of utilizing the store-within-store concept is not new. The upscale department store Nordstrom has a “Pop-in@Nordstrom” pop-up shop. It partners with manufacturing brands and suppliers to bring a unique shopping experience to its shoppers. For example, it partnered with Hanes to open a “pop-in” T-shirt store over the summer of 2017, featuring 100 custom-designed pieces by almost 40 artists. Nordstrom has also sold drones, instant photo cameras and other technological gadgets at this in-store pop-up. These are products not typically carried by the department store, so their presence creates excitement for the shoppers, and gives them another reason to revisit the store.

Department stores such as Hudson’s Bay also make use of pop-ups to increase foot traffic. By inviting national brand Levi’s to set up a pop-up shop, it attracted loyal Levi’s fans to visit Hudson’s Bay to check out the latest offerings from their beloved brand.

3.5 Bringing Food and Fashion to New Neighbourhoods

Food trucks and mobile fashion boutiques have gained popularity in recent years. These pop-ups help aspiring entrepreneurs to realize their business dreams using specially-configured trucks. According to the American Mobile Retail Association (AMRA), there are over 500 mobile trucks operating across the US.15 In Canada, we can find not only food trucks on the street, but also fashion boutiques on wheels.

Key Takeaways

In this chapter, you learned:

- about how pop-ups can target consumers based on their demographic characteristics and psychographic profiles

- that pop-up shops are great for consumers who (i) want to buy local, (ii) have a fear of missing out, (iii) enjoy shopping and (iv) demonstrate a high level of consumer innovativeness

- about some examples of pop-up shop formats and their ideal target markets

Key Terms:

- Market Segmentation

- Millennials

- Consumer Innovativeness

Mini Case Study

Figure 5.12: Uncle Tetsu’s pop-up shop at Yorkdale’s CONCEPT

Founded in 1985, Uncle Tetsu is a cheesecake shop from Japan. The super soft, rich and flavourful freshly baked cheesecake has gained popularity not only in Japan but also internationally. It landed in Toronto on March 18, 2015 with a store at Bay and Dundas16 and has expanded to four stores since then. In April 2017, Uncle Tetsu participated in a month-long retail initiative organized by Oxford Properties, to set up a pop-up shop at a multi-vendor retailing space called CONCEPT at the Yorkdale Shopping Centre.17 It was a great success with shoppers often seen queuing up in front of the pop-up shop.

The Canadian management team for Uncle Tetsu is now planning for growth and they are wondering about the role of a pop-up shop in their expansion plan.

Consider the following questions:

- How can Uncle Tetsu benefit from this pop-up shop in Yorkdale?

- Would the pop-up shop cannibalize the sales of its existing four shops in town?

- Should Uncle Tetsu open up more pop-up shops around the city, considering that this may reduce the exclusivity and excitement of the shopping experience?

References

- Statistics Canada. (2017). “Study: A look at immigration, ethnocultural diversity and languages in Canada up to 2036, 2011 to 2036.” The Daily. January 25.

- Statistics Canada. (2017). “Age and sex, and type of dwelling data: Key results from the 2016 Census.” The Daily. May 3.

- Statistics Canada. (2016, Feb 19). “Canadian Demographics at a Glance Second Edition.” Statistics Canada.

- Babin, B. J., Murray, K. B., & Harris, E. G. (2014). CB. Toronto, ON: Nelson Education. (p.111)

- Dunne, P. M., Lusch, R. F., & Carver, J. R. (2011). Retailing (7th ed.). Mason, OH: South-Western Cengage Learning.

- Barton, C., Fromm, J., & Egan, C. (2012, April 16). The millennial consumer. BCG Perspectives.

- Johnson, L. (2014, October 24). IHeartRadio’s vending machine turns Instagram photos into swag. Adweek.

- Spencer, N. (2012, October 18). 2nd generation of social is here: 4 social customer segments to watch. Business to Community.

- Babin, B. J., Murray, K. B., & Harris, E. G. (2014). CB. Toronto, ON: Nelson Education. (p. 119)

- Berman, B. & Evans, J. R. (2013). Retail management: a strategic approach. Boston, MA: Pearson.

- Baras, J. (2016). PopUp republic: how to start your own successful pop-up space, shop, or restaurant. Hoboken, NJ: John Wiley & Sons, Inc.

- Kim, H., Fiore, A. M., Niehm, L. S., & Jeong, M. (2010). Psychographic characteristics affecting behavioral intentions towards pop‐up retail. International Journal of Retail & Distribution Management, 38(2), 133-154.

- Niehm, L., Flore, A., Jeong, M., & Kim, H-J. (2006). Pop-up retail’s acceptability as an innovative business strategy and enhancer of the consumer shopping experience. Journal of Shopping Centre Research, 13(2), 1-30.

- Karim, D. (2016, March 19). Zvelle creates shoes for women on the move. StartUp Here Toronto.

- American Mobile Retail Association.

- Hernandez, D. (2015, March 23). Uncle Tetsu brings Japanese cheesecake to Toronto. Metro News.

- Daily Hive (2017, April 4). Yorkdale launches innovative CONCEPT space to showcase local brands in pop-up style program.