Chapter 8 – Price

8.3 Determine Pricing Strategy

LEARNING OBJECTIVES

- Determine pricing strategies.

- Pricing Adjustments over the life of a product

Pricing Strategies

Once a company has established its pricing objectives and analyzed the factors that affect how it should price a product, the company must determine the pricing strategy (or strategies) that will help it achieve those objectives. Companies may use different pricing strategies but it is most important that the strategy selected achieve the objective set (profit, sales or status orientation). Sometimes, a particular strategy is selected based on the stage of the product’s life cycle, the stage of development of a new market, or the relaunch of an existing product.

Product pricing strategies in the introductory stage can vary depending on the type of product, competing products, the extra value the product provides consumers versus existing offerings, and the costs of developing and producing the product. Two strategies that are widely used in the introductory stage are penetration pricing, price skimming or giving the product or service away for free.

A penetration pricing strategy involves using a low price with the goal being to get as many consumers as possible to try the product. Penetration pricing is used on many new food products, health and beauty supplies, and paper products. The organization hopes to sell a high volume in order to generate substantial revenues. The low initial price of the product is often combined with advertising, coupons, samples, or other special incentives to increase awareness of the product and get consumers to try it.

A company uses a price skimming strategy, which involves setting a high initial price for a product, to more quickly recoup the investment related to its development and marketing. The skimming strategy attracts the top, or high end, of the market. Generally, this market consists of customers who are early adopters of products or who are very interested in the product and are therefore less sensitive to price. An example of price skimming would be driverless or autonomous cars.‡ A high price must be consistent with the nature of the product (e.g. revolutionary innovation versus evolutionary) as well as the other marketing strategies being used to promote it. For example, engaging in personal selling to customers, running ads targeting small and specific groups of customers, and placing the product in a limited number of distribution outlets are likely to be strategies that companies use in conjunction with a skimming approach.

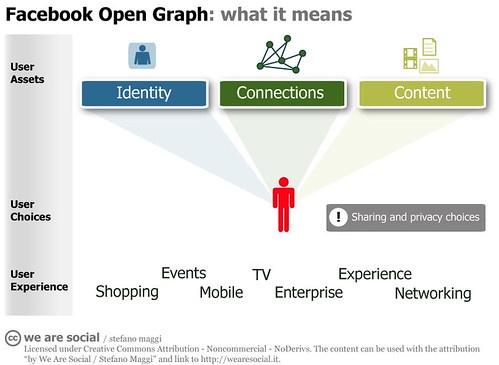

Giving away a product or service for free is considered a pricing strategy and is often used by technology companies to encourage trial. The company may offer a basic app for free to new customers. Some companies allow the use of the ‘basic’ app for free over the long term. These typically have limited function but offer enough to induce customers to sign-up for them. Over time, companies will encourage customers to sign up for a one-time fee or subscription by providing information about additional features available, or by reducing the functionality of the free service. Of course, while a service may be monetarily free, the company may charge a different non-monetary price. Facebook is well known for selling its users’ information to advertisers in exchange for access to its platform (BBC News, 2018). ‡

Companies can choose many ways to set their prices for existing products or services. Many stores use cost-plus pricing, in which they take the cost of the product and then add a profit to determine a price. Cost-plus pricing is very common. The strategy helps ensure that the product costs are covered and the company earns a certain amount of profit. When companies add a markup, or an amount added to the cost of a product, they are using a form of cost-plus pricing. When products go on sale, companies mark down the prices, but they usually still make a profit. Potential markdowns or price reductions should be considered when deciding on a starting price.

Many pricing approaches have a psychological appeal. Odd-even pricing occurs when a company prices a product a few cents or a few dollars below the next dollar amount. For example, instead of being priced $400.00, an Xbox 360 was priced at $399.99 to encourage more sales. That’s because consumers perceive a product priced at $399 as being a better deal because the number is in the 300s whereas 400 is not. ‡

Prestige pricing occurs when a higher price is utilized to give an offering a high-quality image. Some stores have a quality image, and people perceive that perhaps the products from those stores are of higher quality. Many times, two different stores carry the same product, but one store prices it higher because of the store’s perceived higher image.

Belts are often priced using a strategy known as price lining, or price levels. This is often used in categories where there is little to differentiate these products in terms of function or there are a few large manufacturers and retailers who want an efficient inventory management system. In other words, there may be only a few price levels ($25, $50, and $75) for belts, but a large assortment of them at each level. Movies and music often use price lining. You may see a lot of online movies for $2.99, $4.99, and perhaps $12.99 for a new release, but you won’t see a lot of different price levels. ‡

Knowing that people have certain maximum levels that consumers are willing to pay, some companies use demand backward pricing. These strategies are often used for time limited products such as holiday products. They start with the price demanded by consumers (what they want to pay) and create offerings at that price. If you shop before the holidays, you might see a table of different products being sold for $5 (mugs, picture frames, ornaments) and another table of products being sold for $10 (mugs with chocolate, decorative trays, and so forth). Similarly, people have certain prices they are willing to pay for wedding gifts, $25, $50, $75, or $100, so stores set up displays of gifts sold at these different price levels. IKEA sets a price that the company believes consumers want to pay, and then, working backward from the price, designs the product.

Loss leader pricing involves pricing one or more items low to get people into a store. The products with low prices are often on the front page of store ads and “lead” the promotion. For example, prior to Thanksgiving, grocery stores advertise turkeys and cranberry sauce at very low prices. The goal is to get shoppers to buy many more items in addition to the low-priced items. Leader or low prices are legal; however, as you learned earlier, loss leaders, or items priced below cost in an effort to get people into stores, are illegal in many states.

Another approach some retailers use is everyday low prices. Walmart goes as far to offer its customers whether shopping in store or online, an ‘Every Day Low Price’ guarantee. ‡

Price bundling occurs when different offerings are sold together at a price that’s typically lower than the total price a customer would pay by buying each offering separately. Combo meals and value meals sold at restaurants are an example. Companies such as McDonald’s have promoted value meals for a long time in many different markets. Other products such as shampoo and conditioner are sometimes bundled together. Automobile companies bundle product options. For example, power locks and windows are often sold together, regardless of whether customers want only one or the other. The idea behind bundling is to increase a company’s revenues.

Captive pricing is a strategy companies use when consumers must buy a given product because they are at a certain event or location or they need a particular product because no substitutes will work. Concessions at a sporting event or a movie provide examples of how captive pricing is used. Maybe you didn’t pay much to attend the game, but the snacks and drinks were extremely expensive. Similarly, if a consumer buys a Gillette Wilkinson Sword Vintage Double Edge Safety Razor and purchase new razor blades for it, that is captive pricing. The blades are often more expensive than the razor because customers do not have the option of choosing blades from another manufacturer.‡

Pricing products consumers use together (such as blades and razors) with different profit margins is also part of product mix pricing. If you want to buy a printer, the base price might seem reasonable, even really low, but the cost of the ink cartridge often seems much higher relative to the cost of the printer. That’s because the ink cartridge is necessary to operation of the printer, consumers must buy the printer cartridge that is goes with their printer and in this way the seller a much higher profit margin. While consumers can buy generic printer cartridges for less, many consumers will pay for the brand name printer cartridge manufactured by the printer company.‡

In Canada, there is lots of criticism of the major cell phone carriers for the amount they charge for data (Thurton, 2020).‡ Depending on your plan, it may involve two-part pricing. Two-part pricing means there are two different charges customers pay. In the case of a mobile phone, a customer might pay a charge for one service such as a thousand minutes, and then pay a separate charge for each minute over one thousand.

Have you ever seen an ad for a special item only to find out it is much more expensive than what you recalled seeing in the ad? A company might advertise a price such as $25*, but when you read the fine print, the price is really five payments of $25 for a total cost of $125. Payment pricing, or allowing customers to pay for products in installments, is a strategy that helps customers break up their payments into smaller amounts, which can make them more inclined to buy higher-priced products. Installment pricing has often been used for expensive items such as furniture but the Shopping Channel offers a program they call Easy Pay where the purchase price for almost any item can be paid over several payments without interest when using a credit card (TSC, n.d.). ‡

Promotional pricing is a short-term tactic designed to get people into a store or to purchase more of a product. Examples of promotional pricing include back-to-school sales, rebates, extended warranties, and going-out-of-business sales. Rebates are a great strategy for companies because consumers think they’re getting a great deal but many consumers forget to request the rebate. Extended warranties have become popular for all types of products, including automobiles, appliances, electronics, and even athletic shoes. If you buy a vacuum for $100, and it has a one-year warranty from the manufacturer, does it really make sense to spend an additional $25 to get another year’s warranty? However, when it comes to automobiles, repairs can be expensive, so an extended warranty often pays for itself following one repair. Buyers must look at the costs and benefits and determine if the extended warranty provides value.

Dynamic pricing is the (fully or partially) automated adjustment of prices. It is most easily done online. The price offered to the consumer can vary by their browser, their online search patterns and their past purchase behavior.‡ Amazon has been a leader in e-commerce dynamic pricing. It reprices millions of items as frequently as every few minutes. Unless a manufacturer sells through its own website, dynamic pricing benefits the retailer who can maximize the revenue of the products it is selling. With the growth in online price consolidators available to consumers, some consumers believe that the price is not fixed nor does it reflect the costs of the retailer. In a way, the price is disconnected from the value of the product. ‡ Another way to use dynamic pricing is on promotions, bundles, personalized offers, and shipping fees (Bondi et al., 2021).

Subscription based pricing has been applied to software (Microsoft Office 360, Apple iCloud), content (Netflix, Amazon Video Prime), and products from razors (Dollar Shaving Club) to beauty products (Vegan Cuts Beauty Box) and clothing (Frank and Oak Style Plan). For a weekly, monthly or annual fee, a product or service is automatically sent to the customer on a periodic basis. Some companies allow the customer to set the time-frame. Using the answers provided by the customer to a few questions, Dollar Shaving Club estimates when the customer will need their next shipment of shaving products and ships them accordingly (Dollar Shave Club, n.d.).‡

Price differentiation, or charging different customers different prices for the same product. In some situations, price discrimination is legal. As we explained, you have probably noticed that certain customer groups (students, children, and senior citizens, for example) are sometimes offered discounts at restaurants and events. However, the discounts must be offered to all senior citizens or all children within a certain age range, not just a few. Price discrimination is used to get more people to use a product or service. Similarly, a company might lower its prices in order to get more customers to buy an offering when business is slow.

Sealed bid pricing is the process of offering to buy or sell products at prices designated in sealed bids. Companies must submit their bids by a certain time. The bids are later reviewed all at once, and the most desirable one is chosen. Sealed bids can occur on either the supplier or the buyer side. Via sealed bids, oil companies bid on tracts of land for potential drilling purposes, and the highest bidder is awarded the right to drill on the land. Similarly, consumers sometimes bid on lots to build houses. The highest bidder gets the lot. On the supplier side, contractors often bid on different jobs and the lowest bidder is awarded the job. The government often makes purchases based on sealed bids. Projects funded by stimulus money were awarded based on sealed bids.

Bids are also being used online. Online auction sites such as eBay give customers the chance to bid and negotiate prices with sellers until an acceptable price is agreed upon. When a buyer lists what he or she wants to buy, sellers may submit bids. This process is known as a forward auction. If the buyer not only lists what he or she wants to buy but also states how much he or she is willing to pay, a reverse auction occurs. The reverse auction is finished when at least one company is willing to accept the buyer’s price.

Going-rate pricing occurs when buyers pay the same price regardless of where they buy the product or from whom. Going-rate pricing is often used on commodity products or which operate in government regulated markets such as wheat, gold, or silver. People perceive the individual products in markets such as these to be largely the same. Consequently, there’s a “going” price for the product that all sellers receive.

Price Adjustments

Companies must also decide what their policies are when it comes to making price adjustments, or changing the listed prices of their products. Some common price adjustments include quantity discounts, which involves giving customers discounts for larger purchases. Discounts for paying cash for large purchases and seasonal discounts to get rid of inventory and holiday items are other examples of price adjustments.

A company’s price adjustment policies also need to outline the company’s shipping charges. Many online merchants offer free shipping on certain products, orders over a certain amount, or purchases made in a given time frame. FOB (free on board) origin and FOB delivered are two common pricing adjustments businesses use to show when the title to a product changes, along with who pays the shipping charges. FOB origin means the title changes at the origin, that is, when the product is purchased, and the buyer pays the shipping charges. FOB destination means the title changes at the destination, that is, after the product is transported, and the seller pays the shipping charges.

Uniform-delivered pricing, also called postage-stamp pricing, means buyers pay the same shipping charges regardless of where they are located. If you mail a letter across town, the postage is the same as when you mail a letter to a different province.

Trade allowances are a way for retailers to improve their profitability.‡ A manufacturer pays the store an advertising allowance to advertise the manufacturer’s products in its apps or printed flyers. Manufacturers pay for each shelf facing they get in a store. Some placements are more valuable than others. Examples include the middle shelf or the ones at the end of the aisle.‡ Similarly, a manufacturer might offer a store a discount to restock the manufacturer’s products on store shelves rather than having its own representatives restock the items.

Reciprocal agreements are agreements in which merchants agree to promote each other to customers. For example, the Royal Ontario Museum in Toronto has reciprocal agreements so that Royal Ontario Museum members can get discounts on the price of admission or meals at other museums (Royal Ontario Museum, n.d.). ‡

A popular promotion tactic that serves to encourage customers to revisit a brick and mortar or an online store is called a bounce back. A bounce back is a promotion in which a seller gives customers discount cards or coupons after purchasing a product. Consumers can then use the cards and coupons on their next visit. The idea is to get the customers to return to the store or online outlets later, and purchase additional items. Some stores set minimum dollar amounts, products, or a specific time when it must be used.

Mark’s is a Canadian retail chain that sells industrial and casual apparel, footwear, and accessories. The company is part of the Canadian Tire Family of Companies. When a customer makes a purchase, they receive a coupon for their next purchase. One such coupon reads: “Save $20 When You Spend $100 or More, Before Taxes. Code Valid April 8 – 14, 2021 In-Store or On Marks.Com” (Mark’s, n.d.).‡